Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter of 2018. Trends reversed 180 degrees in 2019 amid Powell’s pivot and optimistic expectations towards a trade deal with China. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were increasing their overall exposure in the third quarter and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards First Midwest Bancorp Inc (NASDAQ:FMBI).

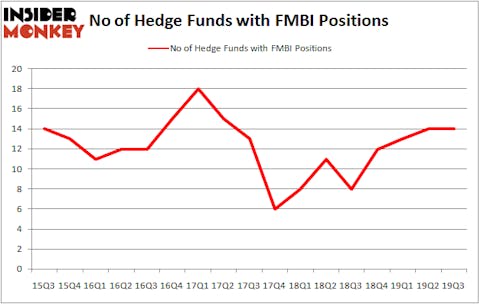

First Midwest Bancorp Inc (NASDAQ:FMBI) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 14 hedge funds’ portfolios at the end of September. At the end of this article we will also compare FMBI to other stocks including Avis Budget Group Inc. (NASDAQ:CAR), Adient plc (NYSE:ADNT), and Otter Tail Corporation (NASDAQ:OTTR) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Michael Price of MFP Investors

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. Let’s take a gander at the key hedge fund action surrounding First Midwest Bancorp Inc (NASDAQ:FMBI).

How are hedge funds trading First Midwest Bancorp Inc (NASDAQ:FMBI)?

At Q3’s end, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the second quarter of 2019. By comparison, 8 hedge funds held shares or bullish call options in FMBI a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in First Midwest Bancorp Inc (NASDAQ:FMBI) was held by Pzena Investment Management, which reported holding $30.2 million worth of stock at the end of September. It was followed by Millennium Management with a $20.3 million position. Other investors bullish on the company included MFP Investors, D E Shaw, and Tricadia Capital Management. In terms of the portfolio weights assigned to each position Tricadia Capital Management allocated the biggest weight to First Midwest Bancorp Inc (NASDAQ:FMBI), around 33.86% of its 13F portfolio. MFP Investors is also relatively very bullish on the stock, setting aside 0.77 percent of its 13F equity portfolio to FMBI.

Judging by the fact that First Midwest Bancorp Inc (NASDAQ:FMBI) has faced bearish sentiment from hedge fund managers, it’s easy to see that there is a sect of hedgies that decided to sell off their positions entirely last quarter. It’s worth mentioning that Dmitry Balyasny’s Balyasny Asset Management dropped the biggest investment of the “upper crust” of funds tracked by Insider Monkey, worth close to $0.5 million in stock. John Overdeck and David Siegel’s fund, Two Sigma Advisors, also cut its stock, about $0.5 million worth. These transactions are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to First Midwest Bancorp Inc (NASDAQ:FMBI). We will take a look at Avis Budget Group Inc. (NASDAQ:CAR), Adient plc (NYSE:ADNT), Otter Tail Corporation (NASDAQ:OTTR), and Tri Pointe Group Inc (NYSE:TPH). This group of stocks’ market values match FMBI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CAR | 21 | 951854 | 0 |

| ADNT | 25 | 590269 | 7 |

| OTTR | 14 | 79670 | 2 |

| TPH | 24 | 230367 | 7 |

| Average | 21 | 463040 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $463 million. That figure was $74 million in FMBI’s case. Adient plc (NYSE:ADNT) is the most popular stock in this table. On the other hand Otter Tail Corporation (NASDAQ:OTTR) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks First Midwest Bancorp Inc (NASDAQ:FMBI) is even less popular than OTTR. Hedge funds clearly dropped the ball on FMBI as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on FMBI as the stock returned 10.7% during the fourth quarter (through the end of November) and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.