The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge funds have been producing disappointing net returns in recent years, however that was partly due to the poor performance of small-cap stocks in general. Well, small-cap stocks finally turned the corner and have been beating the large-cap stocks by more than 10 percentage points over the last 5 months.This means the relevancy of hedge funds’ public filings became inarguable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards First Midwest Bancorp Inc (NASDAQ:FMBI).

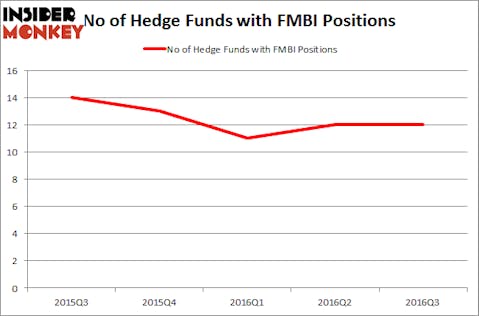

Hedge fund interest in First Midwest Bancorp Inc (NASDAQ:FMBI) shares was flat at the end of last quarter, with 12 hedge funds bullish on the stock. This is usually a negative indicator. At the end of this article we will also compare FMBI to other stocks including Heartland Express, Inc. (NASDAQ:HTLD), Chico’s FAS, Inc. (NYSE:CHS), and Flagstar Bancorp Inc (NYSE:FBC) to get a better sense of its popularity.

Follow First Midwest Bancorp Inc (NASDAQ:FMBI)

Follow First Midwest Bancorp Inc (NASDAQ:FMBI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Kevin George/Shutterstock.com

What have hedge funds been doing with First Midwest Bancorp Inc (NASDAQ:FMBI)?

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, unchanged from one quarter earlier. The graph below displays the number of hedge funds with bullish position in FMBI over the last 5 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Millennium Management, one of the 10 largest hedge funds in the world, holds the largest position in First Midwest Bancorp Inc (NASDAQ:FMBI). Millennium Management has a $34.7 million position in the stock. Sitting at the No. 2 spot is Pzena Investment Management, led by Richard S. Pzena, holding a $32.4 million position. Some other hedge funds and institutional investors that hold long positions include Jim Simons’ Renaissance Technologies, John Overdeck and David Siegel’s Two Sigma Advisors and Cliff Asness’ AQR Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.