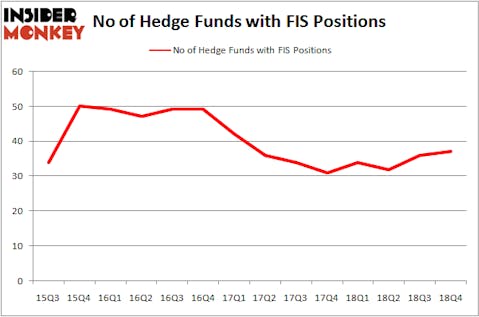

Fidelity National Information Services Inc. (NYSE:FIS) was in 37 hedge funds’ portfolios at the end of the fourth quarter of 2018. FIS has seen an increase in support from the world’s most elite money managers of late. There were 36 hedge funds in our database with FIS holdings at the end of the previous quarter. Our calculations also showed that FIS isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a glance at the new hedge fund action surrounding Fidelity National Information Services Inc. (NYSE:FIS).

How are hedge funds trading Fidelity National Information Services Inc. (NYSE:FIS)?

At the end of the fourth quarter, a total of 37 of the hedge funds tracked by Insider Monkey were long this stock, a change of 3% from one quarter earlier. By comparison, 34 hedge funds held shares or bullish call options in FIS a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

The largest stake in Fidelity National Information Services Inc. (NYSE:FIS) was held by Cantillon Capital Management, which reported holding $439.3 million worth of stock at the end of September. It was followed by D E Shaw with a $281.1 million position. Other investors bullish on the company included Farallon Capital, Two Sigma Advisors, and Millennium Management.

As aggregate interest increased, specific money managers were breaking ground themselves. Millennium Management, managed by Israel Englander, initiated the biggest position in Fidelity National Information Services Inc. (NYSE:FIS). Millennium Management had $86.7 million invested in the company at the end of the quarter. Lee Hicks and Jan Koerner’s Park Presidio Capital also initiated a $40 million position during the quarter. The other funds with new positions in the stock are Ricky Sandler’s Eminence Capital, Clint Carlson’s Carlson Capital, and Vikas Lunia’s Lunia Capital.

Let’s now review hedge fund activity in other stocks similar to Fidelity National Information Services Inc. (NYSE:FIS). We will take a look at BB&T Corporation (NYSE:BBT), ICICI Bank Limited (NYSE:IBN), Canadian Imperial Bank of Commerce (NYSE:CM), and Ecopetrol S.A. (NYSE:EC). This group of stocks’ market values resemble FIS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BBT | 31 | 131659 | 11 |

| IBN | 26 | 745695 | 4 |

| CM | 15 | 358649 | 1 |

| EC | 16 | 192561 | 3 |

| Average | 22 | 357141 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $357 million. That figure was $1540 million in FIS’s case. BB&T Corporation (NYSE:BBT) is the most popular stock in this table. On the other hand Canadian Imperial Bank of Commerce (NYSE:CM) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Fidelity National Information Services Inc. (NYSE:FIS) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately FIS wasn’t in this group. Hedge funds that bet on FIS were disappointed as the stock returned 6.5% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.