The Insider Monkey team has completed processing the quarterly 13F filings for the March quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Esperion Therapeutics, Inc. (NASDAQ:ESPR).

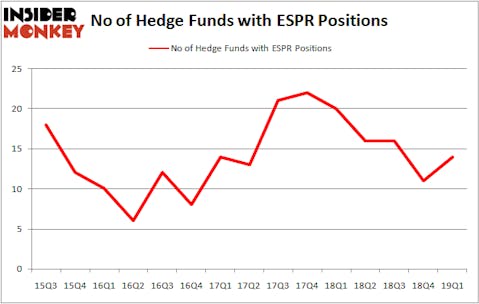

Esperion Therapeutics, Inc. (NASDAQ:ESPR) was in 14 hedge funds’ portfolios at the end of March. ESPR investors should be aware of an increase in enthusiasm from smart money in recent months. There were 11 hedge funds in our database with ESPR positions at the end of the previous quarter. Our calculations also showed that ESPR isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are several formulas stock market investors use to evaluate stocks. A couple of the most underrated formulas are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the top investment managers can beat the S&P 500 by a very impressive margin (see the details here).

We’re going to take a look at the fresh hedge fund action surrounding Esperion Therapeutics, Inc. (NASDAQ:ESPR).

How have hedgies been trading Esperion Therapeutics, Inc. (NASDAQ:ESPR)?

Heading into the second quarter of 2019, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 27% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards ESPR over the last 15 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

More specifically, Pentwater Capital Management was the largest shareholder of Esperion Therapeutics, Inc. (NASDAQ:ESPR), with a stake worth $99.4 million reported as of the end of March. Trailing Pentwater Capital Management was Partner Fund Management, which amassed a stake valued at $65.3 million. Millennium Management, GLG Partners, and Point72 Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, some big names have been driving this bullishness. Point72 Asset Management, managed by Steve Cohen, initiated the most outsized position in Esperion Therapeutics, Inc. (NASDAQ:ESPR). Point72 Asset Management had $8.7 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $4.4 million position during the quarter. The other funds with new positions in the stock are Matthew Hulsizer’s PEAK6 Capital Management, Jeffrey Talpins’s Element Capital Management, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Esperion Therapeutics, Inc. (NASDAQ:ESPR) but similarly valued. We will take a look at The Andersons, Inc. (NASDAQ:ANDE), Orthofix Medical Inc. (NASDAQ:OFIX), Cavco Industries, Inc. (NASDAQ:CVCO), and AZZ Incorporated (NYSE:AZZ). This group of stocks’ market valuations are similar to ESPR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ANDE | 8 | 44338 | 2 |

| OFIX | 19 | 91743 | 1 |

| CVCO | 19 | 125424 | -3 |

| AZZ | 16 | 43674 | 1 |

| Average | 15.5 | 76295 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $76 million. That figure was $212 million in ESPR’s case. Orthofix Medical Inc. (NASDAQ:OFIX) is the most popular stock in this table. On the other hand The Andersons, Inc. (NASDAQ:ANDE) is the least popular one with only 8 bullish hedge fund positions. Esperion Therapeutics, Inc. (NASDAQ:ESPR) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on ESPR as the stock returned 26.1% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.