Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 817 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Equifax Inc. (NYSE:EFX).

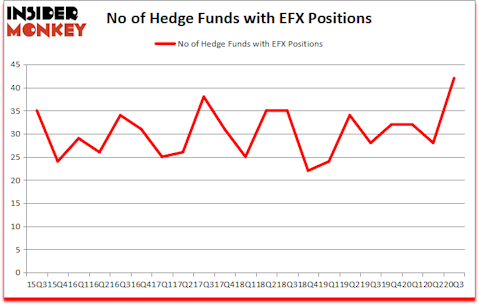

Is EFX a good stock to buy now? Hedge funds were betting on the stock. The number of long hedge fund positions inched up by 14 lately. Equifax Inc. (NYSE:EFX) was in 42 hedge funds’ portfolios at the end of the third quarter of 2020. The all time high for this statistic is 38. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that EFX isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

According to most market participants, hedge funds are perceived as worthless, outdated financial vehicles of yesteryear. While there are over 8000 funds with their doors open at the moment, We look at the leaders of this club, about 850 funds. It is estimated that this group of investors oversee bulk of the smart money’s total asset base, and by paying attention to their matchless stock picks, Insider Monkey has found a few investment strategies that have historically beaten the market. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Our portfolio of short stocks lost 13% since February 2017 (through November 17th) even though the market was up 65% during the same period. We just shared a list of 6 short targets in our latest quarterly update .

David Blood of Generation Investment Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this cannabis tech stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Keeping this in mind let’s view the key hedge fund action encompassing Equifax Inc. (NYSE:EFX).

Do Hedge Funds Think EFX Is A Good Stock To Buy Now?

At third quarter’s end, a total of 42 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 50% from the second quarter of 2020. The graph below displays the number of hedge funds with bullish position in EFX over the last 21 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, William von Mueffling’s Cantillon Capital Management has the biggest position in Equifax Inc. (NYSE:EFX), worth close to $359.2 million, amounting to 3% of its total 13F portfolio. Sitting at the No. 2 spot is Generation Investment Management, led by David Blood and Al Gore, holding a $321.6 million position; the fund has 1.7% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that are bullish contain Greg Poole’s Echo Street Capital Management, Farallon Capital and James Parsons’s Junto Capital Management. In terms of the portfolio weights assigned to each position Harbor Spring Capital allocated the biggest weight to Equifax Inc. (NYSE:EFX), around 4.69% of its 13F portfolio. Cantillon Capital Management is also relatively very bullish on the stock, setting aside 3 percent of its 13F equity portfolio to EFX.

As aggregate interest increased, specific money managers have been driving this bullishness. Junto Capital Management, managed by James Parsons, created the biggest position in Equifax Inc. (NYSE:EFX). Junto Capital Management had $60.6 million invested in the company at the end of the quarter. David Fiszel’s Honeycomb Asset Management also initiated a $21.2 million position during the quarter. The other funds with brand new EFX positions are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Dmitry Balyasny’s Balyasny Asset Management, and Peter Muller’s PDT Partners.

Let’s check out hedge fund activity in other stocks similar to Equifax Inc. (NYSE:EFX). These stocks are Fortis Inc. (NYSE:FTS), Canadian Natural Resources Limited (NYSE:CNQ), Take-Two Interactive Software, Inc. (NASDAQ:TTWO), Coupa Software Incorporated (NASDAQ:COUP), First Republic Bank (NYSE:FRC), Zscaler, Inc. (NASDAQ:ZS), and Suncor Energy Inc. (NYSE:SU). This group of stocks’ market valuations are closest to EFX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FTS | 8 | 411986 | 0 |

| CNQ | 30 | 233173 | 2 |

| TTWO | 52 | 1289470 | -9 |

| COUP | 50 | 3191469 | 0 |

| FRC | 31 | 1221714 | -6 |

| ZS | 26 | 489528 | -9 |

| SU | 22 | 559413 | -7 |

| Average | 31.3 | 1056679 | -4.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.3 hedge funds with bullish positions and the average amount invested in these stocks was $1057 million. That figure was $1266 million in EFX’s case. Take-Two Interactive Software, Inc. (NASDAQ:TTWO) is the most popular stock in this table. On the other hand Fortis Inc. (NYSE:FTS) is the least popular one with only 8 bullish hedge fund positions. Equifax Inc. (NYSE:EFX) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for EFX is 78.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 32.9% in 2020 through December 8th and still beat the market by 16.2 percentage points. Hedge funds were also right about betting on EFX as the stock returned 17.7% since the end of Q3 (through 12/8) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Equifax Inc (NYSE:EFX)

Follow Equifax Inc (NYSE:EFX)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.