At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Eagle Bulk Shipping Inc. (NASDAQ:EGLE).

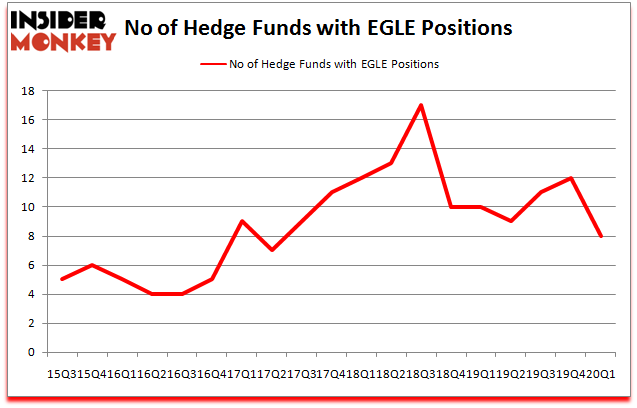

Eagle Bulk Shipping Inc. (NASDAQ:EGLE) shareholders have witnessed a decrease in hedge fund sentiment lately. EGLE was in 8 hedge funds’ portfolios at the end of the first quarter of 2020. There were 12 hedge funds in our database with EGLE positions at the end of the previous quarter. Our calculations also showed that EGLE isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 58 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 36% through May 18th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, We take a look at lists like the 10 most profitable companies in the world to identify the compounders that are likely to deliver double digit returns. We interview hedge fund managers and ask them about their best ideas. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. For example we are checking out stocks recommended/scorned by legendary Bill Miller. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. Now let’s take a gander at the latest hedge fund action encompassing Eagle Bulk Shipping Inc. (NASDAQ:EGLE).

How are hedge funds trading Eagle Bulk Shipping Inc. (NASDAQ:EGLE)?

At Q1’s end, a total of 8 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -33% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards EGLE over the last 18 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

More specifically, Oaktree Capital Management was the largest shareholder of Eagle Bulk Shipping Inc. (NASDAQ:EGLE), with a stake worth $54.7 million reported as of the end of September. Trailing Oaktree Capital Management was GoldenTree Asset Management, which amassed a stake valued at $25.5 million. Royce & Associates, Mangrove Partners, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position GoldenTree Asset Management allocated the biggest weight to Eagle Bulk Shipping Inc. (NASDAQ:EGLE), around 4.72% of its 13F portfolio. Oaktree Capital Management is also relatively very bullish on the stock, dishing out 1.54 percent of its 13F equity portfolio to EGLE.

Because Eagle Bulk Shipping Inc. (NASDAQ:EGLE) has witnessed bearish sentiment from the entirety of the hedge funds we track, it’s safe to say that there lies a certain “tier” of hedge funds that slashed their entire stakes heading into Q4. At the top of the heap, David Brown’s Hawk Ridge Management dropped the biggest stake of all the hedgies followed by Insider Monkey, totaling an estimated $11.8 million in stock. D. E. Shaw’s fund, D E Shaw, also cut its stock, about $0.5 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest dropped by 4 funds heading into Q4.

Let’s also examine hedge fund activity in other stocks similar to Eagle Bulk Shipping Inc. (NASDAQ:EGLE). These stocks are Empresa Distribuidora y Comercializadora Norte Sociedad Anonima (NYSE:EDN), Mastech Digital, Inc. (NYSE:MHH), Dyadic International, Inc. (NASDAQ:DYAI), and Rockwell Medical Inc (NASDAQ:RMTI). This group of stocks’ market valuations are closest to EGLE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EDN | 2 | 73 | -3 |

| MHH | 4 | 1750 | 2 |

| DYAI | 3 | 5386 | -5 |

| RMTI | 3 | 492 | 0 |

| Average | 3 | 1925 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 3 hedge funds with bullish positions and the average amount invested in these stocks was $2 million. That figure was $86 million in EGLE’s case. Mastech Digital, Inc. (NYSE:MHH) is the most popular stock in this table. On the other hand Empresa Distribuidora y Comercializadora Norte Sociedad Anonima (NYSE:EDN) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Eagle Bulk Shipping Inc. (NASDAQ:EGLE) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 12.2% in 2020 through June 17th but still managed to beat the market by 14.8 percentage points. Hedge funds were also right about betting on EGLE as the stock returned 28.6% so far in Q2 (through June 17th) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Eagle Bulk Shipping Inc. (AMEX:EGLE)

Follow Eagle Bulk Shipping Inc. (AMEX:EGLE)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.