Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved dearly, lost nearly 40% of its value at one point in 2018. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 20 S&P 500 stocks among hedge funds beat the S&P 500 Index by nearly 10 percentage points so far in 2019. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of Dycom Industries, Inc. (NYSE:DY).

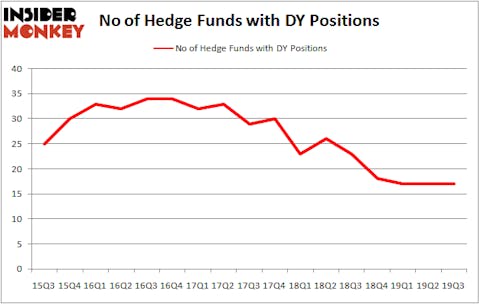

Dycom Industries, Inc. (NYSE:DY) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 17 hedge funds’ portfolios at the end of September. At the end of this article we will also compare DY to other stocks including Corcept Therapeutics Incorporated (NASDAQ:CORT), Newmark Group, Inc. (NASDAQ:NMRK), and NBT Bancorp Inc. (NASDAQ:NBTB) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are numerous formulas stock traders have at their disposal to assess their holdings. Some of the most underrated formulas are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the best fund managers can trounce the S&P 500 by a healthy amount (see the details here).

Lee Ainslie of Maverick Capital

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. Let’s check out the recent hedge fund action surrounding Dycom Industries, Inc. (NYSE:DY).

What have hedge funds been doing with Dycom Industries, Inc. (NYSE:DY)?

At the end of the third quarter, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. By comparison, 23 hedge funds held shares or bullish call options in DY a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, ACK Asset Management, managed by Richard S. Meisenberg, holds the number one position in Dycom Industries, Inc. (NYSE:DY). ACK Asset Management has a $21.4 million position in the stock, comprising 6% of its 13F portfolio. The second largest stake is held by Renaissance Technologies, which holds a $15.1 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Some other members of the smart money with similar optimism include Ken Griffin’s Citadel Investment Group, John Overdeck and David Siegel’s Two Sigma Advisors and Marc Majzner’s Clearline Capital. In terms of the portfolio weights assigned to each position ACK Asset Management allocated the biggest weight to Dycom Industries, Inc. (NYSE:DY), around 6.02% of its 13F portfolio. Clearline Capital is also relatively very bullish on the stock, designating 1.07 percent of its 13F equity portfolio to DY.

Seeing as Dycom Industries, Inc. (NYSE:DY) has experienced bearish sentiment from the smart money, it’s safe to say that there was a specific group of funds that decided to sell off their positions entirely heading into Q4. Interestingly, Doug Gordon, Jon Hilsabeck and Don Jabro’s Shellback Capital said goodbye to the largest position of the 750 funds tracked by Insider Monkey, worth close to $6.5 million in stock, and David Keidan’s Buckingham Capital Management was right behind this move, as the fund said goodbye to about $5.1 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Dycom Industries, Inc. (NYSE:DY). These stocks are Corcept Therapeutics Incorporated (NASDAQ:CORT), Newmark Group, Inc. (NASDAQ:NMRK), NBT Bancorp Inc. (NASDAQ:NBTB), and IAMGOLD Corporation (NYSE:IAG). This group of stocks’ market values are similar to DY’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CORT | 18 | 135196 | 1 |

| NMRK | 19 | 111199 | 3 |

| NBTB | 6 | 7606 | -2 |

| IAG | 13 | 148737 | -2 |

| Average | 14 | 100685 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $101 million. That figure was $57 million in DY’s case. Newmark Group, Inc. (NASDAQ:NMRK) is the most popular stock in this table. On the other hand NBT Bancorp Inc. (NASDAQ:NBTB) is the least popular one with only 6 bullish hedge fund positions. Dycom Industries, Inc. (NYSE:DY) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately DY wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on DY were disappointed as the stock returned 2% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.