At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

Having said that, let’s see whether Dunkin Brands Group Inc (NASDAQ:DNKN) represents a buy right now. Prominent investors are reducing their bets on the stock. During the third quarter, the number of investors followed by us betting on the stock inched down by one to 20. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Arris Group, Inc. (NASDAQ:ARRS), Validus Holdings, Ltd. (NYSE:VR), and Bright Horizons Family Solutions Inc (NYSE:BFAM) to gather more data points.

Follow Dunkin' Brands Group Inc. (NASDAQ:DNKN)

Follow Dunkin' Brands Group Inc. (NASDAQ:DNKN)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Nadezhda1906/Shutterstock.com

Keeping this in mind, we’re going to analyze the key action encompassing Dunkin Brands Group Inc (NASDAQ:DNKN).

What have hedge funds been doing with Dunkin Brands Group Inc (NASDAQ:DNKN)?

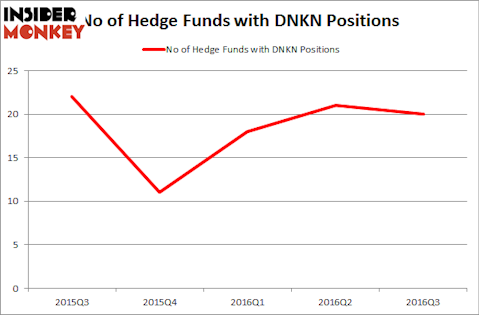

At the end of September, 20 funds tracked by Insider Monkey were long Dunkin Brands Group, down by 5% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in DNKN over the last five quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Ricky Sandler’s Eminence Capital has the biggest position in Dunkin Brands Group Inc (NASDAQ:DNKN), worth close to $207.7 million, amounting to 3.5% of its total 13F portfolio. Coming in second is John Lykouretzos of Hoplite Capital Management, with a $95 million position; the fund has 4.4% of its 13F portfolio invested in the stock. Some other peers that are bullish contain Israel Englander’s Millennium Management, and J Kevin Kenny Jr’s Emerging Sovereign Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually sold off their positions entirely. At the top of the heap, Eashwar Krishnan’s Tybourne Capital Management sold off the biggest stake of all the hedgies studied by Insider Monkey, comprising an estimated $67.3 million in stock, and Aaron Cowen’s Suvretta Capital Management was right behind this move, as the fund dumped about $32.7 million worth of shares.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Dunkin Brands Group Inc (NASDAQ:DNKN) but similarly valued. We will take a look at Arris Group, Inc. (NASDAQ:ARRS), Validus Holdings, Ltd. (NYSE:VR), Bright Horizons Family Solutions Inc (NYSE:BFAM), and DCP Midstream Partners, LP (NYSE:DPM). This group of stocks’ market caps are closest to DNKN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARRS | 39 | 1254065 | 3 |

| VR | 17 | 220326 | -2 |

| BFAM | 12 | 86899 | -3 |

| DPM | 8 | 21744 | 0 |

As you can see these stocks had an average of 19 investors holding long positions and the average amount invested in these stocks was $396 million. That figure was $557 million in DNKN’s case. Arris Group, Inc. (NASDAQ:ARRS) is the most popular stock in this table, while DCP Midstream Partners, LP (NYSE:DPM) is the least popular one with only eight investors having reported bullish bets. Dunkin Brands Group Inc (NASDAQ:DNKN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Arris Group, Inc. (NASDAQ:ARRS) might be a better candidate to consider taking a long position in.