Before putting in our own effort and resources into finding a good investment, we can quickly utilize hedge fund expertise to give us a quick glimpse of whether that stock could make for a good addition to our portfolios. The odds are not exactly stacked in investors’ favor when it comes to beating the market, as evidenced by the fact that less than 49% of the stocks in the S&P 500 did so during the third quarter. The stats were even worse in recent years when most of the advances in the market were due to large gains by FAANG stocks. However, one bright side for individual investors was the strong performance of hedge funds’ top consensus picks. This year hedge funds’ top 20 stock picks outperformed the S&P 500 Index by 9.9 percentage points through the end of November. Thus, we can see that the tireless research and efforts of hedge funds to identify winning stocks can work to our advantage when we know how to use the data. While not all of their picks will be winners, our odds are much better following their best stock picks than trying to go it alone.

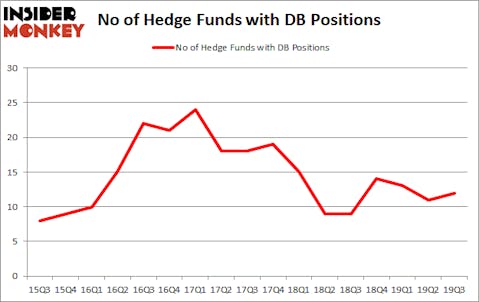

Deutsche Bank AG (NYSE:DB) was in 12 hedge funds’ portfolios at the end of the third quarter of 2019. DB has experienced an increase in support from the world’s most elite money managers of late. There were 11 hedge funds in our database with DB positions at the end of the previous quarter. Our calculations also showed that DB isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Stephen Feinberg of Cerberus Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a peek at the new hedge fund action regarding Deutsche Bank AG (NYSE:DB).

What does smart money think about Deutsche Bank AG (NYSE:DB)?

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 9% from one quarter earlier. By comparison, 9 hedge funds held shares or bullish call options in DB a year ago. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

The largest stake in Deutsche Bank AG (NYSE:DB) was held by Hudson Executive Capital, which reported holding $485.8 million worth of stock at the end of September. It was followed by Cerberus Capital Management with a $464.6 million position. Other investors bullish on the company included Masters Capital Management, Citadel Investment Group, and PEAK6 Capital Management. In terms of the portfolio weights assigned to each position Cerberus Capital Management allocated the biggest weight to Deutsche Bank AG (NYSE:DB), around 60.65% of its 13F portfolio. Hudson Executive Capital is also relatively very bullish on the stock, dishing out 36.75 percent of its 13F equity portfolio to DB.

As aggregate interest increased, specific money managers were leading the bulls’ herd. Nishkama Capital, managed by Ravee Mehta, established the largest call position in Deutsche Bank AG (NYSE:DB). Nishkama Capital had $2.6 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $2.1 million investment in the stock during the quarter. The following funds were also among the new DB investors: Paul Marshall and Ian Wace’s Marshall Wace, John Overdeck and David Siegel’s Two Sigma Advisors, and Robert Rodriguez and Steven Romick’s First Pacific Advisors.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Deutsche Bank AG (NYSE:DB) but similarly valued. These stocks are Nucor Corporation (NYSE:NUE), W.P. Carey Inc. REIT (NYSE:WPC), Apollo Global Management LLC (NYSE:APO), and TransUnion (NYSE:TRU). This group of stocks’ market values are similar to DB’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NUE | 26 | 167282 | 4 |

| WPC | 14 | 38560 | -2 |

| APO | 24 | 1733222 | 1 |

| TRU | 34 | 1040934 | 4 |

| Average | 24.5 | 745000 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.5 hedge funds with bullish positions and the average amount invested in these stocks was $745 million. That figure was $983 million in DB’s case. TransUnion (NYSE:TRU) is the most popular stock in this table. On the other hand W.P. Carey Inc. REIT (NYSE:WPC) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Deutsche Bank AG (NYSE:DB) is even less popular than WPC. Hedge funds dodged a bullet by taking a bearish stance towards DB. Our calculations showed that the top 20 most popular hedge fund stocks returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately DB wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); DB investors were disappointed as the stock returned -3.9% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.