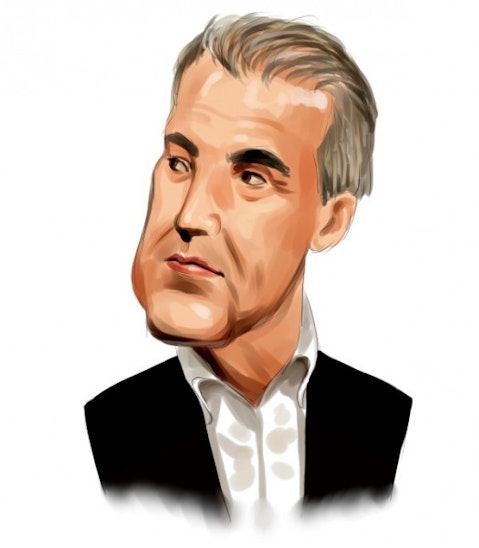

One of billionaire Marc Lasry‘s biggest market fears came true in November when the Democrats regained controlled of the House of Representatives, winning 235 of the 435 seats. The chairman and CEO of $9.7 billion investment firm Avenue Capital warned back in March that a Democrat-controlled house would be bad for the market, which he said wants “a little bit of stability, and they’re not going to have that at all.”

Lasry reiterated that stance this month, suggesting the market’s devastating Q4, which has crushed many of the 30 Most Popular Stocks Among Hedge Funds, is partly due to fears over the turmoil that will ensue in January when the Democrats officially take over the House. “What you’re going to see in January is just problem after problem. And I think the market has started realizing that,” Lasry said on CNBC’s Fast Money Halftime Report.

It should be stressed that Lasry, who’s also co-owner of the Milwaukee Bucks, does not fear Democrat governance. In fact, Lasry is a staunch Democratic supporter, raising funds for both Hillary Clinton and Barack Obama during past election cycles. However, he does fear the uncertainty that will prevail in the marketplace should the Democrats push for further investigations into possible collusion between President Trump and Russia that could’ve impacted the 2016 election or even try to impeach him, though the latter does not appear to be a goal of leading Democrats.

Despite those fears, Lasry, whose personal fortune stands at $1.8 billion according to Forbes’ real time rankings of the world’s richest people, is still relatively bullish on the stock market for 2019. Speaking at the Milwaukee Business Journal’s Power Breakfast last week, Lasry said he thinks the stock market will get back to posting gains next year and that the economy will also continue to grow, though at a slower pace.

In the third quarter, Avenue Capital closed four of its former holdings while opening just one new position. The value of its 13F portfolio also declined to $1.77 billion as of September 30, down from $2.02 billion at the end of June. With minimal quarterly turnover, the fund’s sector allocation remained largely unchanged, with real estate (38.04% weighting), finance (16.45%), and consumer discretionary (15.33%) stocks accounting for the bulk of its holdings.

We’ve uncovered a reliable way to consistently beat the market by using these 13F filings and investing in only the top consensus picks of the 100 best performing hedge funds each quarter. Insider Monkey’s flagship “Best Performing Hedge Funds Strategy” has returned 96.9% since its 2014 inception (through November 2), beating the market by over 40 percentage points. Check out a detailed analysis of Insider Monkey’s performance and past quarterly stock picks for all the details. Our newest picks will be released later this month; don’t miss out!

On the next page we’ll look at five stocks that Marc Lasry and his team were selling during Q3 ahead of the chaotic final quarter of 2018.