We at Insider Monkey have gone over 817 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article, we look at what those funds think of Contura Energy, Inc. (NYSE:CTRA) based on that data.

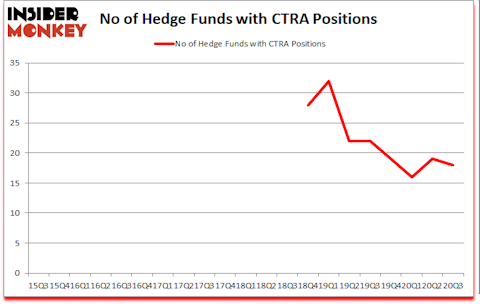

Is CTRA a good stock to buy now? Contura Energy, Inc. (NYSE:CTRA) has experienced a decrease in support from the world’s most elite money managers lately. Contura Energy, Inc. (NYSE:CTRA) was in 18 hedge funds’ portfolios at the end of September. The all time high for this statistic is 32. There were 19 hedge funds in our database with CTRA holdings at the end of June. Our calculations also showed that CTRA isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 113% since March 2017 and outperformed the S&P 500 ETFs by more than 66 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Jeffrey Gendell of Tontine Asset Management

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost real estate prices. So, we recommended this real estate stock to our monthly premium newsletter subscribers. We go through lists like the 15 best blue chip stocks to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind we’re going to take a look at the latest hedge fund action encompassing Contura Energy, Inc. (NYSE:CTRA).

Do Hedge Funds Think CTRA Is A Good Stock To Buy Now?

At the end of September, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -5% from the previous quarter. On the other hand, there were a total of 22 hedge funds with a bullish position in CTRA a year ago. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

More specifically, Highbridge Capital Management was the largest shareholder of Contura Energy, Inc. (NYSE:CTRA), with a stake worth $10.7 million reported as of the end of September. Trailing Highbridge Capital Management was Alta Fundamental Advisers, which amassed a stake valued at $7.1 million. Whitebox Advisors, Tontine Asset Management, and Mangrove Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Alta Fundamental Advisers allocated the biggest weight to Contura Energy, Inc. (NYSE:CTRA), around 7.42% of its 13F portfolio. Tontine Asset Management is also relatively very bullish on the stock, earmarking 1.2 percent of its 13F equity portfolio to CTRA.

Judging by the fact that Contura Energy, Inc. (NYSE:CTRA) has faced bearish sentiment from hedge fund managers, logic holds that there lies a certain “tier” of hedgies that elected to cut their entire stakes by the end of the third quarter. Intriguingly, Michael Gelband’s ExodusPoint Capital sold off the biggest position of all the hedgies tracked by Insider Monkey, totaling close to $0.2 million in stock, and Donald Sussman’s Paloma Partners was right behind this move, as the fund cut about $0.1 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest was cut by 1 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Contura Energy, Inc. (NYSE:CTRA). These stocks are DIRTT Environmental Solutions Ltd. (NASDAQ:DRTT), GSI Technology, Inc. (NASDAQ:GSIT), Nano Dimension Ltd. (NASDAQ:NNDM), Bel Fuse, Inc. (NASDAQ:BELFB), Radcom Ltd. (NASDAQ:RDCM), Evolus, Inc. (NASDAQ:EOLS), and Actinium Pharmaceuticals Inc (NYSE:ATNM). This group of stocks’ market values resemble CTRA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DRTT | 8 | 24577 | -1 |

| GSIT | 4 | 12757 | -1 |

| NNDM | 2 | 172 | 1 |

| BELFB | 7 | 11262 | -1 |

| RDCM | 4 | 9676 | 0 |

| EOLS | 10 | 2356 | 1 |

| ATNM | 6 | 10618 | -1 |

| Average | 5.9 | 10203 | -0.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.9 hedge funds with bullish positions and the average amount invested in these stocks was $10 million. That figure was $47 million in CTRA’s case. Evolus, Inc. (NASDAQ:EOLS) is the most popular stock in this table. On the other hand Nano Dimension Ltd. (NASDAQ:NNDM) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Contura Energy, Inc. (NYSE:CTRA) is more popular among hedge funds. Our overall hedge fund sentiment score for CTRA is 70.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks returned 30.7% in 2020 through December 14th but still managed to beat the market by 15.8 percentage points. Hedge funds were also right about betting on CTRA as the stock returned 79% since the end of September (through 12/14) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Alpha Metallurgical Resources Inc. (NYSE:AMR)

Follow Alpha Metallurgical Resources Inc. (NYSE:AMR)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.