World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

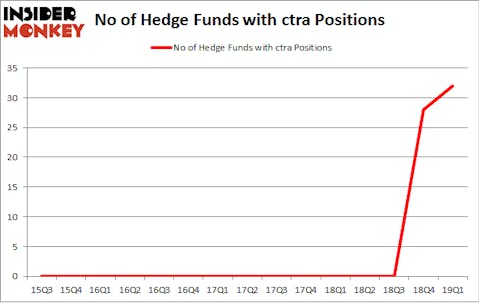

Is Contura Energy, Inc. (NYSE:CTRA) the right pick for your portfolio? The smart money is betting on the stock. The number of long hedge fund bets improved by 4 lately. Our calculations also showed that ctra isn’t among the 30 most popular stocks among hedge funds. CTRA was in 32 hedge funds’ portfolios at the end of the first quarter of 2019. There were 28 hedge funds in our database with CTRA positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Glenn Russell Dubin of Highbridge Capital

We’re going to go over the key hedge fund action regarding Contura Energy, Inc. (NYSE:CTRA).

How have hedgies been trading Contura Energy, Inc. (NYSE:CTRA)?

At the end of the first quarter, a total of 32 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 14% from one quarter earlier. By comparison, 0 hedge funds held shares or bullish call options in CTRA a year ago. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Andy Redleaf’s Whitebox Advisors has the most valuable position in Contura Energy, Inc. (NYSE:CTRA), worth close to $132.3 million, amounting to 4% of its total 13F portfolio. On Whitebox Advisors’s heels is Highbridge Capital Management, managed by Glenn Russell Dubin, which holds a $58.4 million position; 1.8% of its 13F portfolio is allocated to the stock. Remaining peers that are bullish comprise Michel Massoud’s Melqart Asset Management, Christopher Pucillo’s Solus Alternative Asset Management and Jeremy Carton and Gilbert Li’s Alta Fundamental Advisers.

Consequently, specific money managers were breaking ground themselves. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, initiated the biggest position in Contura Energy, Inc. (NYSE:CTRA). Arrowstreet Capital had $5.9 million invested in the company at the end of the quarter. Jerome L. Simon’s Lonestar Capital Management also made a $2.9 million investment in the stock during the quarter. The following funds were also among the new CTRA investors: Ken Griffin’s Citadel Investment Group, Michael Platt and William Reeves’s BlueCrest Capital Mgmt., and Joel Greenblatt’s Gotham Asset Management.

Let’s check out hedge fund activity in other stocks similar to Contura Energy, Inc. (NYSE:CTRA). We will take a look at CBIZ, Inc. (NYSE:CBZ), Uxin Limited (NASDAQ:UXIN), Arbor Realty Trust, Inc. (NYSE:ABR), and Bluegreen Vacations Corporation (NYSE:BXG). This group of stocks’ market valuations are similar to CTRA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CBZ | 16 | 160280 | 4 |

| UXIN | 7 | 98223 | 1 |

| ABR | 9 | 59736 | -6 |

| BXG | 6 | 36372 | 4 |

| Average | 9.5 | 88653 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.5 hedge funds with bullish positions and the average amount invested in these stocks was $89 million. That figure was $448 million in CTRA’s case. CBIZ, Inc. (NYSE:CBZ) is the most popular stock in this table. On the other hand Bluegreen Vacations Corporation (NYSE:BXG) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Contura Energy, Inc. (NYSE:CTRA) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately CTRA wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CTRA were disappointed as the stock returned -6.9% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.