The financial regulations require hedge funds and wealthy investors that crossed the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on June 28th. We at Insider Monkey have made an extensive database of nearly 750 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Cheniere Energy Partners LP (NYSE:CQP) based on those filings.

Hedge fund interest in Cheniere Energy Partners LP (NYSE:CQP) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare CQP to other stocks including Entergy Corporation (NYSE:ETR), Aptiv PLC (NYSE:APTV), and CoStar Group Inc (NASDAQ:CSGP) to get a better sense of its popularity.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a gander at the fresh hedge fund action surrounding Cheniere Energy Partners LP (NYSE:CQP).

How have hedgies been trading Cheniere Energy Partners LP (NYSE:CQP)?

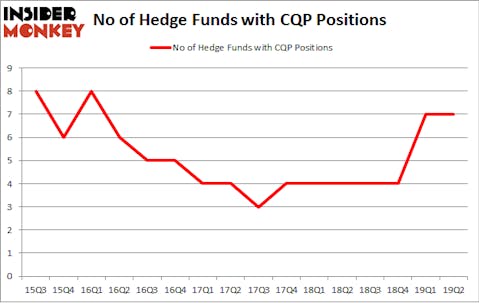

At Q2’s end, a total of 7 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in CQP over the last 16 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Columbus Hill Capital Management, managed by Kevin D. Eng, holds the most valuable position in Cheniere Energy Partners LP (NYSE:CQP). Columbus Hill Capital Management has a $6.4 million position in the stock, comprising 0.6% of its 13F portfolio. On Columbus Hill Capital Management’s heels is Citadel Investment Group, managed by Ken Griffin, which holds a $4.1 million call position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that hold long positions comprise Matthew Hulsizer’s PEAK6 Capital Management and BP Capital.

Due to the fact that Cheniere Energy Partners LP (NYSE:CQP) has experienced bearish sentiment from the entirety of the hedge funds we track, we can see that there were a few hedge funds that slashed their positions entirely in the second quarter. Interestingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital cut the biggest stake of the “upper crust” of funds watched by Insider Monkey, comprising about $3.3 million in call options. Matthew Hulsizer’s fund, PEAK6 Capital Management, also dropped its call options, about $2.4 million worth. These moves are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Cheniere Energy Partners LP (NYSE:CQP) but similarly valued. These stocks are Entergy Corporation (NYSE:ETR), Aptiv PLC (NYSE:APTV), CoStar Group Inc (NASDAQ:CSGP), and Liberty Global plc (NASDAQ:LBTYA). All of these stocks’ market caps match CQP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ETR | 30 | 1492309 | -3 |

| APTV | 26 | 910163 | -7 |

| CSGP | 32 | 1169953 | 0 |

| LBTYA | 27 | 1478573 | -1 |

| Average | 28.75 | 1262750 | -2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.75 hedge funds with bullish positions and the average amount invested in these stocks was $1263 million. That figure was $14 million in CQP’s case. CoStar Group Inc (NASDAQ:CSGP) is the most popular stock in this table. On the other hand Aptiv PLC (NYSE:APTV) is the least popular one with only 26 bullish hedge fund positions. Compared to these stocks Cheniere Energy Partners LP (NYSE:CQP) is even less popular than APTV. Hedge funds clearly dropped the ball on CQP as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks (see the video below) among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on CQP as the stock returned 9.3% during the third quarter and outperformed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.