Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and small-cap stocks underperformed the market. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Cheniere Energy Partners LP (NYSE:CQP) to find out whether it was one of their high conviction long-term ideas.

Hedge fund interest in Cheniere Energy Partners LP (NYSE:CQP) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare CQP to other stocks including Boston Properties, Inc. (NYSE:BXP), SK Telecom Co., Ltd. (NYSE:SKM), and Cerner Corporation (NASDAQ:CERN) to get a better sense of its popularity.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a look at the recent hedge fund action surrounding Cheniere Energy Partners LP (NYSE:CQP).

What does the smart money think about Cheniere Energy Partners LP (NYSE:CQP)?

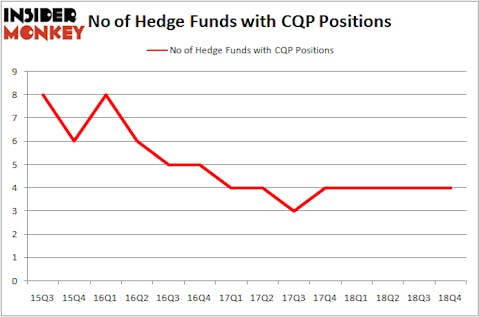

At the end of the fourth quarter, a total of 4 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CQP over the last 14 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Columbus Hill Capital Management, managed by Kevin D. Eng, holds the number one position in Cheniere Energy Partners LP (NYSE:CQP). Columbus Hill Capital Management has a $8.9 million position in the stock, comprising 1.8% of its 13F portfolio. Coming in second is BP Capital, managed by T Boone Pickens, which holds a $2.3 million position; 1.6% of its 13F portfolio is allocated to the company. Remaining members of the smart money with similar optimism encompass Richard Driehaus’s Driehaus Capital, and Jonathan Dawson’s Southport Management.

Seeing as Cheniere Energy Partners LP (NYSE:CQP) has experienced bearish sentiment from the smart money, we can see that there exists a select few hedgies who were dropping their entire stakes in the third quarter. It’s worth mentioning that Matthew Hulsizer’s PEAK6 Capital Management sold off the biggest position of the 700 funds followed by Insider Monkey, totaling about $2 million in stock. Jim Simons’s fund, Renaissance Technologies, also said goodbye to its stock, about $1.7 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Cheniere Energy Partners LP (NYSE:CQP). These stocks are Boston Properties, Inc. (NYSE:BXP), SK Telecom Co., Ltd. (NYSE:SKM), Cerner Corporation (NASDAQ:CERN), and Microchip Technology Incorporated (NASDAQ:MCHP). This group of stocks’ market caps are closest to CQP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BXP | 17 | 348411 | 0 |

| SKM | 6 | 88249 | 1 |

| CERN | 22 | 642762 | -3 |

| MCHP | 30 | 425995 | 7 |

| Average | 18.75 | 376354 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $376 million. That figure was $15 million in CQP’s case. Microchip Technology Incorporated (NASDAQ:MCHP) is the most popular stock in this table. On the other hand SK Telecom Co., Ltd. (NYSE:SKM) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Cheniere Energy Partners LP (NYSE:CQP) is even less popular than SKM. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on CQP, though not to the same extent, as the stock returned 17.6% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.