In this article we are going to use hedge fund sentiment as a tool and determine whether Barrick Gold Corporation (NYSE:GOLD) is a good investment right now. We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

Is GOLD a good stock to buy now? Hedge fund interest in Barrick Gold Corporation (NYSE:GOLD) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that GOLD isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks). At the end of this article we will also compare GOLD to other stocks including Brookfield Asset Management Inc. (NYSE:BAM), Edwards Lifesciences Corporation (NYSE:EW), and China Petroleum & Chemical Corp (NYSE:SNP) to get a better sense of its popularity.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are plenty of indicators market participants use to value publicly traded companies. Some of the less utilized indicators are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the top investment managers can beat the broader indices by a superb margin (see the details here).

Kerr Neilson of Platinum Asset Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets. Tesla’s stock price skyrocketed, yet lithium prices are still below their 2019 highs. So, we are checking out this lithium stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind let’s analyze the latest hedge fund action regarding Barrick Gold Corporation (NYSE:GOLD).

Hedge fund activity in Barrick Gold Corporation (NYSE:GOLD)

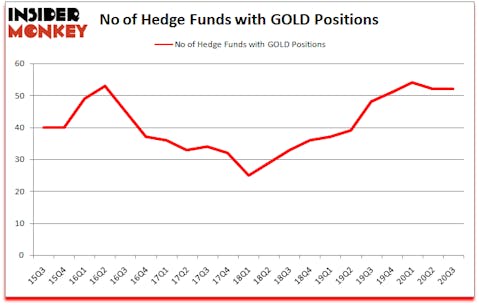

At third quarter’s end, a total of 52 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the second quarter of 2020. On the other hand, there were a total of 48 hedge funds with a bullish position in GOLD a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies, holds the largest position in Barrick Gold Corporation (NYSE:GOLD). Renaissance Technologies has a $603.4 million position in the stock, comprising 0.6% of its 13F portfolio. The second most bullish fund manager is GQG Partners, led by Rajiv Jain, holding a $541 million position; 1.9% of its 13F portfolio is allocated to the company. Remaining professional money managers that are bullish encompass Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Warren Buffett’s Berkshire Hathaway and Kerr Neilson’s Platinum Asset Management. In terms of the portfolio weights assigned to each position Oldfield Partners allocated the biggest weight to Barrick Gold Corporation (NYSE:GOLD), around 13.44% of its 13F portfolio. Kingstown Capital Management is also relatively very bullish on the stock, dishing out 12.07 percent of its 13F equity portfolio to GOLD.

Judging by the fact that Barrick Gold Corporation (NYSE:GOLD) has experienced bearish sentiment from the aggregate hedge fund industry, logic holds that there exists a select few hedgies that decided to sell off their full holdings last quarter. Interestingly, Richard Gerson and Navroz D. Udwadia’s Falcon Edge Capital cut the largest position of the “upper crust” of funds watched by Insider Monkey, valued at close to $15.1 million in stock, and Ken Heebner’s Capital Growth Management was right behind this move, as the fund cut about $14.8 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to Barrick Gold Corporation (NYSE:GOLD). We will take a look at Brookfield Asset Management Inc. (NYSE:BAM), Edwards Lifesciences Corporation (NYSE:EW), China Petroleum & Chemical Corp (NYSE:SNP), Lam Research Corporation (NASDAQ:LRCX), Waste Management, Inc. (NYSE:WM), Aon plc (NYSE:AON), and The Charles Schwab Corporation (NYSE:SCHW). This group of stocks’ market values resemble GOLD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BAM | 35 | 1080514 | 2 |

| EW | 46 | 1122952 | 1 |

| SNP | 8 | 168584 | -2 |

| LRCX | 55 | 2247749 | -7 |

| WM | 38 | 2845066 | -1 |

| AON | 52 | 5410949 | -5 |

| SCHW | 53 | 3280246 | -18 |

| Average | 41 | 2308009 | -4.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 41 hedge funds with bullish positions and the average amount invested in these stocks was $2308 million. That figure was $3096 million in GOLD’s case. Lam Research Corporation (NASDAQ:LRCX) is the most popular stock in this table. On the other hand China Petroleum & Chemical Corp (NYSE:SNP) is the least popular one with only 8 bullish hedge fund positions. Barrick Gold Corporation (NYSE:GOLD) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for GOLD is 80.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 31.6% in 2020 through December 2nd and beat the market again by 16 percentage points. Unfortunately GOLD wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on GOLD were disappointed as the stock returned -14.4% since the end of September (through 12/2) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow Barrick Gold Corp (NYSE:GOLD)

Follow Barrick Gold Corp (NYSE:GOLD)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.