The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the fourth quarter, which unveil their equity positions as of December 31. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards AnaptysBio, Inc. (NASDAQ:ANAB).

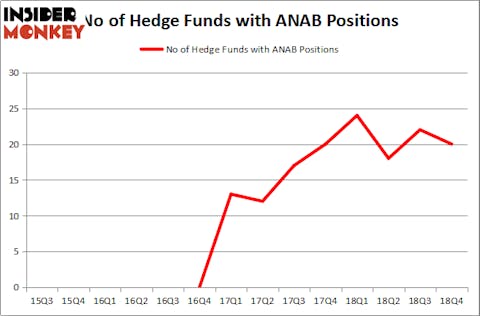

AnaptysBio, Inc. (NASDAQ:ANAB) was in 20 hedge funds’ portfolios at the end of December. ANAB has seen a decrease in hedge fund sentiment of late. There were 22 hedge funds in our database with ANAB holdings at the end of the previous quarter. Our calculations also showed that ANAB isn’t among the 30 most popular stocks among hedge funds.

At the moment there are a lot of methods market participants put to use to size up publicly traded companies. A couple of the less known methods are hedge fund and insider trading moves. We have shown that, historically, those who follow the top picks of the best investment managers can beat their index-focused peers by a significant margin (see the details here).

Let’s take a look at the key hedge fund action surrounding AnaptysBio, Inc. (NASDAQ:ANAB).

What does the smart money think about AnaptysBio, Inc. (NASDAQ:ANAB)?

Heading into the first quarter of 2019, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -9% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ANAB over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Frazier Healthcare Partners held the most valuable stake in AnaptysBio, Inc. (NASDAQ:ANAB), which was worth $147.8 million at the end of the fourth quarter. On the second spot was Adage Capital Management which amassed $146.4 million worth of shares. Moreover, Cormorant Asset Management, Viking Global, and Deerfield Management were also bullish on AnaptysBio, Inc. (NASDAQ:ANAB), allocating a large percentage of their portfolios to this stock.

Seeing as AnaptysBio, Inc. (NASDAQ:ANAB) has witnessed bearish sentiment from hedge fund managers, it’s safe to say that there was a specific group of money managers that decided to sell off their entire stakes in the third quarter. At the top of the heap, Paul Marshall and Ian Wace’s Marshall Wace LLP sold off the largest investment of the “upper crust” of funds monitored by Insider Monkey, totaling close to $10.9 million in stock, and Dmitry Balyasny’s Balyasny Asset Management was right behind this move, as the fund dumped about $8.9 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 2 funds in the third quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as AnaptysBio, Inc. (NASDAQ:ANAB) but similarly valued. These stocks are First Merchants Corporation (NASDAQ:FRME), Stitch Fix, Inc. (NASDAQ:SFIX), Artisan Partners Asset Management Inc (NYSE:APAM), and Appian Corporation (NASDAQ:APPN). All of these stocks’ market caps match ANAB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FRME | 13 | 122400 | 0 |

| SFIX | 20 | 132132 | -1 |

| APAM | 16 | 118757 | 3 |

| APPN | 9 | 246766 | 1 |

| Average | 14.5 | 155014 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.5 hedge funds with bullish positions and the average amount invested in these stocks was $155 million. That figure was $623 million in ANAB’s case. Stitch Fix, Inc. (NASDAQ:SFIX) is the most popular stock in this table. On the other hand Appian Corporation (NASDAQ:APPN) is the least popular one with only 9 bullish hedge fund positions. AnaptysBio, Inc. (NASDAQ:ANAB) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately ANAB wasn’t nearly as popular as these 15 stock and hedge funds that were betting on ANAB were disappointed as the stock returned 13% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.