The financial regulations require hedge funds and wealthy investors that crossed the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on June 28th. We at Insider Monkey have made an extensive database of nearly 750 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Allogene Therapeutics, Inc. (NASDAQ:ALLO) based on those filings.

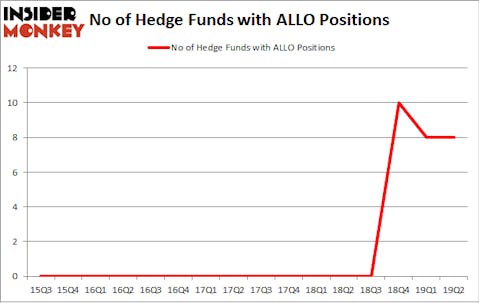

Allogene Therapeutics, Inc. (NASDAQ:ALLO) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 8 hedge funds’ portfolios at the end of June. At the end of this article we will also compare ALLO to other stocks including Switch, Inc. (NYSE:SWCH), Darling Ingredients Inc. (NYSE:DAR), and Taro Pharmaceutical Industries Ltd. (NYSE:TARO) to get a better sense of its popularity. Our calculations also showed that ALLO isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are a lot of signals investors have at their disposal to size up stocks. A couple of the most under-the-radar signals are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the top picks of the best fund managers can outperform the S&P 500 by a superb amount (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a look at the fresh hedge fund action encompassing Allogene Therapeutics, Inc. (NASDAQ:ALLO).

Hedge fund activity in Allogene Therapeutics, Inc. (NASDAQ:ALLO)

At Q2’s end, a total of 8 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 0 hedge funds with a bullish position in ALLO a year ago. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

Among these funds, Perceptive Advisors held the most valuable stake in Allogene Therapeutics, Inc. (NASDAQ:ALLO), which was worth $41.5 million at the end of the second quarter. On the second spot was venBio Select Advisor which amassed $30.3 million worth of shares. Moreover, Wildcat Capital Management, Citadel Investment Group, and DSAM Partners were also bullish on Allogene Therapeutics, Inc. (NASDAQ:ALLO), allocating a large percentage of their portfolios to this stock.

Since Allogene Therapeutics, Inc. (NASDAQ:ALLO) has experienced a decline in interest from the entirety of the hedge funds we track, logic holds that there is a sect of funds that elected to cut their positions entirely last quarter. It’s worth mentioning that James E. Flynn’s Deerfield Management sold off the largest stake of the “upper crust” of funds tracked by Insider Monkey, comprising an estimated $9.4 million in stock, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital was right behind this move, as the fund cut about $0.8 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Allogene Therapeutics, Inc. (NASDAQ:ALLO) but similarly valued. We will take a look at Switch, Inc. (NYSE:SWCH), Darling Ingredients Inc. (NYSE:DAR), Taro Pharmaceutical Industries Ltd. (NYSE:TARO), and Semtech Corporation (NASDAQ:SMTC). This group of stocks’ market caps resemble ALLO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SWCH | 13 | 220988 | -3 |

| DAR | 16 | 193087 | -3 |

| TARO | 10 | 72472 | 0 |

| SMTC | 17 | 208784 | -2 |

| Average | 14 | 173833 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $174 million. That figure was $106 million in ALLO’s case. Semtech Corporation (NASDAQ:SMTC) is the most popular stock in this table. On the other hand Taro Pharmaceutical Industries Ltd. (NYSE:TARO) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Allogene Therapeutics, Inc. (NASDAQ:ALLO) is even less popular than TARO. Hedge funds dodged a bullet by taking a bearish stance towards ALLO. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately ALLO wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); ALLO investors were disappointed as the stock returned 1.5% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.