We can judge whether International Game Technology PLC (NYSE:IGT) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

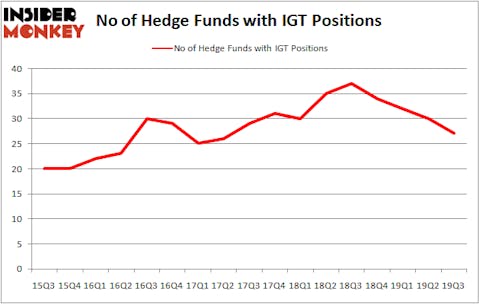

International Game Technology PLC (NYSE:IGT) investors should pay attention to a decrease in activity from the world’s largest hedge funds lately. Our calculations also showed that IGT isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s view the latest hedge fund action encompassing International Game Technology PLC (NYSE:IGT).

What does smart money think about International Game Technology PLC (NYSE:IGT)?

Heading into the fourth quarter of 2019, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -10% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in IGT over the last 17 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

Among these funds, Samlyn Capital held the most valuable stake in International Game Technology PLC (NYSE:IGT), which was worth $68.9 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $35.3 million worth of shares. PAR Capital Management, AQR Capital Management, and Lonestar Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Covalent Capital Partners allocated the biggest weight to International Game Technology PLC (NYSE:IGT), around 8.47% of its portfolio. Lonestar Capital Management is also relatively very bullish on the stock, earmarking 4.71 percent of its 13F equity portfolio to IGT.

Judging by the fact that International Game Technology PLC (NYSE:IGT) has faced a decline in interest from hedge fund managers, we can see that there is a sect of fund managers that elected to cut their entire stakes in the third quarter. It’s worth mentioning that Parag Vora’s HG Vora Capital Management dropped the biggest investment of the “upper crust” of funds monitored by Insider Monkey, totaling an estimated $48 million in stock. Steve Cohen’s fund, Point72 Asset Management, also cut its stock, about $11.7 million worth. These transactions are important to note, as aggregate hedge fund interest fell by 3 funds in the third quarter.

Let’s now review hedge fund activity in other stocks similar to International Game Technology PLC (NYSE:IGT). These stocks are TC Pipelines, LP (NYSE:TCP), Advanced Disposal Services, Inc. (NYSE:ADSW), Magnolia Oil & Gas Corporation (NYSE:MGY), and BlackBerry Limited (NYSE:BB). This group of stocks’ market valuations resemble IGT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TCP | 5 | 17286 | 0 |

| ADSW | 24 | 668160 | -2 |

| MGY | 17 | 132628 | -2 |

| BB | 28 | 401792 | 3 |

| Average | 18.5 | 304967 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.5 hedge funds with bullish positions and the average amount invested in these stocks was $305 million. That figure was $234 million in IGT’s case. BlackBerry Limited (NYSE:BB) is the most popular stock in this table. On the other hand TC Pipelines, LP (NYSE:TCP) is the least popular one with only 5 bullish hedge fund positions. International Game Technology PLC (NYSE:IGT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on IGT, though not to the same extent, as the stock returned 5.9% during the first two months of the fourth quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.