Amid an overall bull market, many stocks that smart money investors were collectively bullish on surged through October 17th. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 45% and 39% respectively. Our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 20 large-cap stock picks generated a return of 24.4% during the first 9 months of 2019 and outperformed the broader market benchmark by 4 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

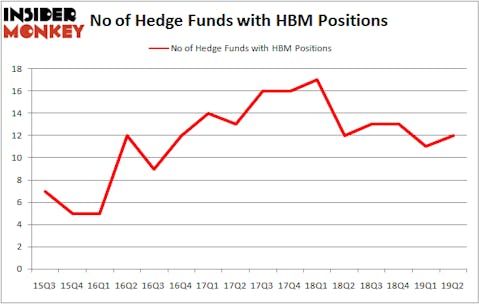

Is HudBay Minerals Inc (NYSE:HBM) a splendid investment today? The best stock pickers are turning bullish. The number of bullish hedge fund bets inched up by 1 recently. Our calculations also showed that HBM isn’t among the 30 most popular stocks among hedge funds (see the video below). HBM was in 12 hedge funds’ portfolios at the end of the second quarter of 2019. There were 11 hedge funds in our database with HBM positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are plenty of metrics stock traders can use to evaluate stocks. A pair of the most innovative metrics are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the best fund managers can outclass the broader indices by a very impressive margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a gander at the fresh hedge fund action encompassing HudBay Minerals Inc (NYSE:HBM).

How are hedge funds trading HudBay Minerals Inc (NYSE:HBM)?

At Q2’s end, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 9% from the previous quarter. On the other hand, there were a total of 12 hedge funds with a bullish position in HBM a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in HudBay Minerals Inc (NYSE:HBM) was held by GMT Capital, which reported holding $162.7 million worth of stock at the end of March. It was followed by Citadel Investment Group with a $24.1 million position. Other investors bullish on the company included Renaissance Technologies, GLG Partners, and D E Shaw.

As one would reasonably expect, some big names were breaking ground themselves. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, initiated the biggest position in HudBay Minerals Inc (NYSE:HBM). Arrowstreet Capital had $3.3 million invested in the company at the end of the quarter. Lee Ainslie’s Maverick Capital also made a $1.5 million investment in the stock during the quarter. The only other fund with a new position in the stock is Peter Algert and Kevin Coldiron’s Algert Coldiron Investors.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as HudBay Minerals Inc (NYSE:HBM) but similarly valued. We will take a look at Blucora Inc (NASDAQ:BCOR), G-III Apparel Group, Ltd. (NASDAQ:GIII), Cloudera, Inc. (NYSE:CLDR), and Papa John’s International, Inc. (NASDAQ:PZZA). This group of stocks’ market caps match HBM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BCOR | 16 | 127514 | 4 |

| GIII | 13 | 74478 | -5 |

| CLDR | 25 | 129316 | -7 |

| PZZA | 22 | 332227 | 0 |

| Average | 19 | 165884 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $166 million. That figure was $225 million in HBM’s case. Cloudera, Inc. (NYSE:CLDR) is the most popular stock in this table. On the other hand G-III Apparel Group, Ltd. (NASDAQ:GIII) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks HudBay Minerals Inc (NYSE:HBM) is even less popular than GIII. Hedge funds dodged a bullet by taking a bearish stance towards HBM. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately HBM wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); HBM investors were disappointed as the stock returned -33.1% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.