Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards Hudbay Minerals Inc. (NYSE:HBM).

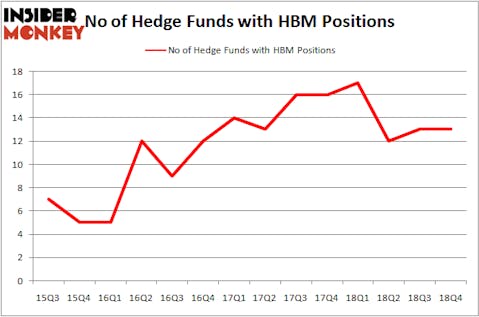

Hudbay Minerals Inc. (NYSE:HBM) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 13 hedge funds’ portfolios at the end of December. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Esperion Therapeutics, Inc. (NASDAQ:ESPR), Cannae Holdings, Inc. (NYSE:CNNE), and TPG RE Finance Trust, Inc. (NYSE:TRTX) to gather more data points.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a glance at the new hedge fund action encompassing Hudbay Minerals Inc. (NYSE:HBM).

How are hedge funds trading Hudbay Minerals Inc. (NYSE:HBM)?

At the end of the fourth quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the second quarter of 2018. On the other hand, there were a total of 17 hedge funds with a bullish position in HBM a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, GMT Capital was the largest shareholder of Hudbay Minerals Inc. (NYSE:HBM), with a stake worth $146.3 million reported as of the end of December. Trailing GMT Capital was Arrowstreet Capital, which amassed a stake valued at $8.7 million. Renaissance Technologies, GLG Partners, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Hudbay Minerals Inc. (NYSE:HBM) has witnessed bearish sentiment from the entirety of the hedge funds we track, logic holds that there was a specific group of funds that elected to cut their positions entirely by the end of the third quarter. At the top of the heap, MacKenzie B. Davis and Kenneth L. Settles Jr’s SailingStone Capital Partners sold off the largest position of all the hedgies watched by Insider Monkey, valued at an estimated $7.3 million in stock. Kevin Michael Ulrich and Anthony Davis’s fund, Anchorage Advisors, also dropped its stock, about $5.1 million worth. These transactions are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to Hudbay Minerals Inc. (NYSE:HBM). These stocks are Esperion Therapeutics, Inc. (NASDAQ:ESPR), Cannae Holdings, Inc. (NYSE:CNNE), TPG RE Finance Trust, Inc. (NYSE:TRTX), and Berkshire Hills Bancorp, Inc. (NYSE:BHLB). All of these stocks’ market caps match HBM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ESPR | 11 | 225795 | -5 |

| CNNE | 23 | 179733 | 0 |

| TRTX | 9 | 27112 | -1 |

| BHLB | 11 | 32334 | 3 |

| Average | 13.5 | 116244 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $116 million. That figure was $176 million in HBM’s case. Cannae Holdings, Inc. (NYSE:CNNE) is the most popular stock in this table. On the other hand TPG RE Finance Trust, Inc. (NYSE:TRTX) is the least popular one with only 9 bullish hedge fund positions. Hudbay Minerals Inc. (NYSE:HBM) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on HBM as the stock returned 48.3% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.