We are still in an overall bull market and many stocks that smart money investors were piling into surged in 2019. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained more than 57% each. Hedge funds’ top 3 stock picks returned 45.7% last year and beat the S&P 500 ETFs by more than 14 percentage points. That’s a big deal. This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

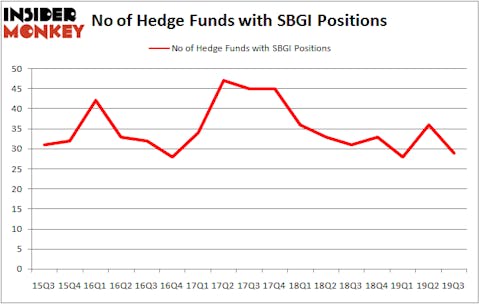

Is Sinclair Broadcast Group, Inc. (NASDAQ:SBGI) worth your attention right now? Prominent investors are turning less bullish. The number of long hedge fund positions decreased by 7 in recent months. Our calculations also showed that SBGI isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

To most shareholders, hedge funds are seen as worthless, outdated investment tools of the past. While there are more than 8000 funds trading today, We choose to focus on the crème de la crème of this club, approximately 750 funds. It is estimated that this group of investors manage bulk of the smart money’s total asset base, and by tracking their matchless picks, Insider Monkey has figured out a number of investment strategies that have historically outstripped the market. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

David E. Shaw of D.E. Shaw

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Now let’s review the new hedge fund action regarding Sinclair Broadcast Group, Inc. (NASDAQ:SBGI).

How have hedgies been trading Sinclair Broadcast Group, Inc. (NASDAQ:SBGI)?

At the end of the third quarter, a total of 29 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -19% from one quarter earlier. On the other hand, there were a total of 31 hedge funds with a bullish position in SBGI a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Sinclair Broadcast Group, Inc. (NASDAQ:SBGI), with a stake worth $175.1 million reported as of the end of September. Trailing Renaissance Technologies was AQR Capital Management, which amassed a stake valued at $83.8 million. Raging Capital Management, D E Shaw, and Beach Point Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Beach Point Capital Management allocated the biggest weight to Sinclair Broadcast Group, Inc. (NASDAQ:SBGI), around 12.22% of its 13F portfolio. Raging Capital Management is also relatively very bullish on the stock, designating 8.17 percent of its 13F equity portfolio to SBGI.

Since Sinclair Broadcast Group, Inc. (NASDAQ:SBGI) has experienced falling interest from the smart money, logic holds that there is a sect of funds that decided to sell off their entire stakes heading into Q4. At the top of the heap, Ken Heebner’s Capital Growth Management cut the largest investment of the 750 funds monitored by Insider Monkey, worth about $33.7 million in stock, and Seth Klarman’s Baupost Group was right behind this move, as the fund dumped about $29.5 million worth. These transactions are important to note, as total hedge fund interest dropped by 7 funds heading into Q4.

Let’s check out hedge fund activity in other stocks similar to Sinclair Broadcast Group, Inc. (NASDAQ:SBGI). These stocks are Shake Shack Inc (NYSE:SHAK), Cracker Barrel Old Country Store, Inc. (NASDAQ:CBRL), Penske Automotive Group, Inc. (NYSE:PAG), and Compania de Minas Buenaventura S.A.A. (NYSE:BVN). This group of stocks’ market caps are similar to SBGI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SHAK | 26 | 607030 | -1 |

| CBRL | 21 | 240229 | -1 |

| PAG | 16 | 63851 | -1 |

| BVN | 6 | 14159 | -1 |

| Average | 17.25 | 231317 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $231 million. That figure was $468 million in SBGI’s case. Shake Shack Inc (NYSE:SHAK) is the most popular stock in this table. On the other hand Compania de Minas Buenaventura S.A.A. (NYSE:BVN) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Sinclair Broadcast Group, Inc. (NASDAQ:SBGI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately SBGI wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SBGI were disappointed as the stock returned 29% in 2019 and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 65 percent of these stocks outperformed the market in 2019.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.