Insider Monkey finished processing more than 700 13F filings made by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of September 30. What do these smart investors think about Sinclair Broadcast Group, Inc. (NASDAQ:SBGI)?

Hedge funds remained bearish on Sinclair Broadcast Group, Inc. (NASDAQ:SBGI) for a third-straight quarter in Q3, as there was a net decline in the number of shareholders of the stock, which has fallen by 31% in 2018. Jay Petschek and Steven Major’s Corsair Capital Management was one of the hedge funds that bailed on SBGI over the past few quarters, a decision which it explained in its Q2 investor letter:

“Sinclair Broadcasting Group (‘SBGI’), which actually rose very slightly during the quarter, was a detractor for the fund. In early Q2, rumors persisted that “core” ads were not rebounding as sharply as hoped after a challenging Q1, sending broadcasting stocks lower. Then, in early May, SBGI rallied on stronger than expected divestiture proceeds associated with its proposed acquisition of Tribune Media (“TRCO”). We exited our position in SBGI during Q2 given a) the greater than expected softness in “core” advertising which looks to be a continued headwind and b) the increasingly lengthy regulatory approval process that is now subject to seemingly unending political pressures. While we still believe that the broadcast business, with its steady retransmission fees and its spectrum optionality, is misunderstood, we don’t see a catalyst for meaningful re-rating, especially given the worse than expected ad environment. Last week’s FCC vote to send the proposed SBGI/TRCO merger to a hearing process has now put the broader deal in jeopardy, reflective of what has been a much more trying approval process than we initially underwrote. SBGI closed the quarter at $32.15,” Corsair Capital Management wrote.

In the eyes of most investors, hedge funds are perceived as worthless, outdated investment vehicles of years past. While there are greater than 8,000 funds trading at the moment, our researchers choose to focus on the masters of this group, around 700 funds. These hedge fund managers manage most of the hedge fund industry’s total asset base, and by watching their top investments, Insider Monkey has determined numerous investment strategies that have historically surpassed the broader indices. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 26.1% since February 2017 even though the market was up nearly 19% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

What does the smart money think about Sinclair Broadcast Group, Inc. (NASDAQ:SBGI)?

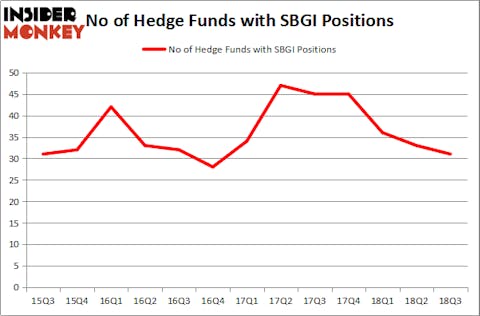

At the end of the third quarter, a total of 31 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 6% drop from the previous quarter. The graph below displays the number of hedge funds with bullish position in SBGI over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, HG Vora Capital Management was the largest shareholder of Sinclair Broadcast Group, Inc. (NASDAQ:SBGI), with a stake worth $177.2 million reported as of the end of September. Trailing HG Vora Capital Management was Omega Advisors, which amassed a stake valued at $94.2 million. Baupost Group, Raging Capital Management, and Goodnow Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Sinclair Broadcast Group, Inc. (NASDAQ:SBGI) has experienced a decline in interest from the aggregate hedge fund industry, logic holds that there exists a select few money managers that elected to cut their full holdings heading into Q3. Interestingly, Matthew Sidman’s Three Bays Capital dropped the largest position of the “upper crust” of funds monitored by Insider Monkey, valued at an estimated $80.2 million in stock, and Kenneth Mario Garschina’s Mason Capital Management was right behind this move, as the fund sold off about $54.5 million worth. These moves are interesting, as aggregate hedge fund interest dropped by 2 funds heading into Q3.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Sinclair Broadcast Group, Inc. (NASDAQ:SBGI) but similarly valued. These stocks are Adtalem Global Education Inc. (NYSE:ATGE), Eventbrite Inc. (NYSE:EB), Orbotech Ltd. (NASDAQ:ORBK), and The RMR Group Inc. (NASDAQ:RMR). This group of stocks’ market values are similar to SBGI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ATGE | 16 | 210396 | 2 |

| EB | 20 | 592474 | 20 |

| ORBK | 27 | 587111 | 3 |

| RMR | 9 | 43789 | -2 |

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $358 million. That figure was $568 million in SBGI’s case. Orbotech Ltd. (NASDAQ:ORBK) is the most popular stock in this table. On the other hand The RMR Group Inc. (NASDAQ:RMR) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Sinclair Broadcast Group, Inc. (NASDAQ:SBGI) is more popular among hedge funds. However, we would like to see hedge fund ownership stabilize before we consider a long position in this stock.

Disclosure: None. This article was originally published at Insider Monkey.