Legendary investors such as Jeffrey Talpins and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze Sinclair Broadcast Group, Inc. (NASDAQ:SBGI) from the perspective of those elite funds.

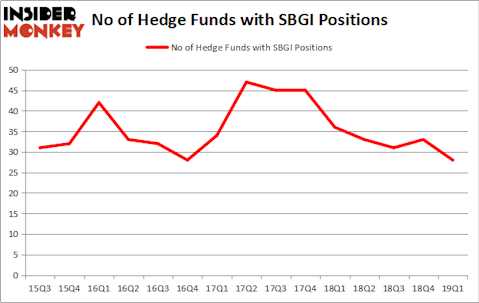

Is Sinclair Broadcast Group, Inc. (NASDAQ:SBGI) a healthy stock for your portfolio? Investors who are in the know are taking a bearish view. The number of bullish hedge fund positions went down by 5 in recent months. Our calculations also showed that SBGI isn’t among the 30 most popular stocks among hedge funds. SBGI was in 28 hedge funds’ portfolios at the end of the first quarter of 2019. There were 33 hedge funds in our database with SBGI holdings at the end of the previous quarter.

At the moment there are many methods stock traders have at their disposal to evaluate publicly traded companies. A pair of the most useful methods are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the top money managers can outclass the S&P 500 by a superb margin (see the details here).

We’re going to take a look at the recent hedge fund action regarding Sinclair Broadcast Group, Inc. (NASDAQ:SBGI).

Hedge fund activity in Sinclair Broadcast Group, Inc. (NASDAQ:SBGI)

At the end of the first quarter, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -15% from the fourth quarter of 2018. On the other hand, there were a total of 36 hedge funds with a bullish position in SBGI a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Jim Simons’s Renaissance Technologies has the most valuable position in Sinclair Broadcast Group, Inc. (NASDAQ:SBGI), worth close to $123.9 million, comprising 0.1% of its total 13F portfolio. On Renaissance Technologies’s heels is Baupost Group, led by Seth Klarman, holding a $111.9 million position; 0.9% of its 13F portfolio is allocated to the company. Remaining peers with similar optimism encompass William C. Martin’s Raging Capital Management, Edward Goodnow’s Goodnow Investment Group and Ken Griffin’s Citadel Investment Group.

Due to the fact that Sinclair Broadcast Group, Inc. (NASDAQ:SBGI) has faced falling interest from the entirety of the hedge funds we track, logic holds that there was a specific group of hedge funds who were dropping their positions entirely heading into Q3. Interestingly, William C. Martin’s Raging Capital Management sold off the biggest position of the “upper crust” of funds watched by Insider Monkey, valued at about $21.1 million in stock. Vasan Kesavan, Srikumar Kesavan and Sandeep Ramesh’s fund, Meghalaya Partners, also cut its stock, about $10.8 million worth. These transactions are important to note, as total hedge fund interest dropped by 5 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks similar to Sinclair Broadcast Group, Inc. (NASDAQ:SBGI). These stocks are Associated Banc Corp (NYSE:ASB), Hancock Whitney Corporation (NASDAQ:HWC), First Hawaiian, Inc. (NASDAQ:FHB), and Allogene Therapeutics, Inc. (NASDAQ:ALLO). This group of stocks’ market values are similar to SBGI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ASB | 16 | 216472 | -2 |

| HWC | 15 | 112402 | 0 |

| FHB | 23 | 384375 | 2 |

| ALLO | 8 | 120844 | -2 |

| Average | 15.5 | 208523 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $209 million. That figure was $497 million in SBGI’s case. First Hawaiian, Inc. (NASDAQ:FHB) is the most popular stock in this table. On the other hand Allogene Therapeutics, Inc. (NASDAQ:ALLO) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Sinclair Broadcast Group, Inc. (NASDAQ:SBGI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on SBGI as the stock returned 37.9% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.