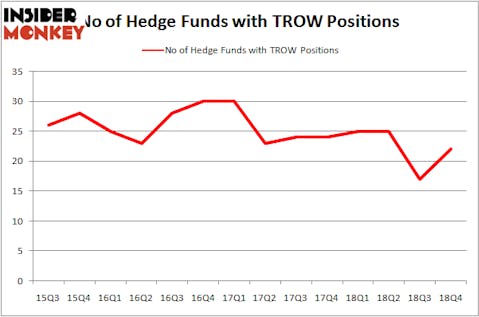

T. Rowe Price Group, Inc. (NASDAQ:TROW) was in 22 hedge funds’ portfolios at the end of December. TROW investors should be aware of an increase in hedge fund sentiment in recent months. There were 17 hedge funds in our database with TROW holdings at the end of the previous quarter. Our calculations also showed that TROW isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to check out the latest hedge fund action surrounding T. Rowe Price Group, Inc. (NASDAQ:TROW).

How are hedge funds trading T. Rowe Price Group, Inc. (NASDAQ:TROW)?

At the end of the fourth quarter, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 29% from one quarter earlier. On the other hand, there were a total of 25 hedge funds with a bullish position in TROW a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Jim Simons’s Renaissance Technologies has the largest position in T. Rowe Price Group, Inc. (NASDAQ:TROW), worth close to $82.4 million, amounting to 0.1% of its total 13F portfolio. Sitting at the No. 2 spot is Cliff Asness of AQR Capital Management, with a $48 million position; 0.1% of its 13F portfolio is allocated to the stock. Other members of the smart money that hold long positions encompass Robert Joseph Caruso’s Select Equity Group, Israel Englander’s Millennium Management and Tom Gayner’s Markel Gayner Asset Management.

As one would reasonably expect, some big names were leading the bulls’ herd. Renaissance Technologies, managed by Jim Simons, created the most outsized position in T. Rowe Price Group, Inc. (NASDAQ:TROW). Renaissance Technologies had $82.4 million invested in the company at the end of the quarter. Robert Joseph Caruso’s Select Equity Group also made a $35.9 million investment in the stock during the quarter. The following funds were also among the new TROW investors: Jane Mendillo’s Harvard Management Co, Benjamin A. Smith’s Laurion Capital Management, and Hoon Kim’s Quantinno Capital.

Let’s go over hedge fund activity in other stocks similar to T. Rowe Price Group, Inc. (NASDAQ:TROW). These stocks are ONEOK, Inc. (NYSE:OKE), Anadarko Petroleum Corporation (NYSE:APC), Digital Realty Trust, Inc. (NYSE:DLR), and The Kroger Co. (NYSE:KR). This group of stocks’ market caps are similar to TROW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OKE | 26 | 471015 | -5 |

| APC | 54 | 1760662 | 9 |

| DLR | 23 | 268314 | -11 |

| KR | 33 | 573567 | 3 |

| Average | 34 | 768390 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34 hedge funds with bullish positions and the average amount invested in these stocks was $768 million. That figure was $290 million in TROW’s case. Anadarko Petroleum Corporation (NYSE:APC) is the most popular stock in this table. On the other hand Digital Realty Trust, Inc. (NYSE:DLR) is the least popular one with only 23 bullish hedge fund positions. Compared to these stocks T. Rowe Price Group, Inc. (NASDAQ:TROW) is even less popular than DLR. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately TROW wasn’t in this group. Hedge funds that bet on TROW were disappointed as the stock returned 11.8% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.