During the fourth quarter the Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by nearly 7 percentage points as investors worried over the possible ramifications of rising interest rates. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Wynn Resorts, Limited (NASDAQ:WYNN) and see how the stock is affected by the recent hedge fund activity.

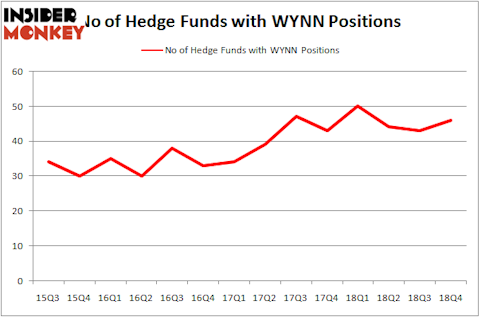

Wynn Resorts, Limited (NASDAQ:WYNN) was in 46 hedge funds’ portfolios at the end of the fourth quarter of 2018. WYNN has experienced an increase in hedge fund sentiment lately. There were 43 hedge funds in our database with WYNN positions at the end of the previous quarter. Our calculations also showed that WYNN isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are many tools stock market investors employ to assess publicly traded companies. A duo of the most useful tools are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the top picks of the best investment managers can outperform their index-focused peers by a superb amount (see the details here).

We’re going to take a glance at the recent hedge fund action surrounding Wynn Resorts, Limited (NASDAQ:WYNN).

What have hedge funds been doing with Wynn Resorts, Limited (NASDAQ:WYNN)?

At Q4’s end, a total of 46 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards WYNN over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Lone Pine Capital, managed by Stephen Mandel, holds the biggest position in Wynn Resorts, Limited (NASDAQ:WYNN). Lone Pine Capital has a $589.1 million position in the stock, comprising 4% of its 13F portfolio. On Lone Pine Capital’s heels is Gabriel Plotkin of Melvin Capital Management, with a $223.2 million position; 3% of its 13F portfolio is allocated to the stock. Remaining members of the smart money that hold long positions include Daniel S. Och’s OZ Management, Mason Hawkins’s Southeastern Asset Management and Daniel Sundheim’s D1 Capital Partners.

With a general bullishness amongst the heavyweights, some big names have jumped into Wynn Resorts, Limited (NASDAQ:WYNN) headfirst. OZ Management, managed by Daniel S. Och, established the biggest position in Wynn Resorts, Limited (NASDAQ:WYNN). OZ Management had $193.1 million invested in the company at the end of the quarter. Mason Hawkins’s Southeastern Asset Management also initiated a $167.7 million position during the quarter. The other funds with brand new WYNN positions are Daniel Sundheim’s D1 Capital Partners, Lee Ainslie’s Maverick Capital, and Mark Moore’s ThornTree Capital Partners.

Let’s now take a look at hedge fund activity in other stocks similar to Wynn Resorts, Limited (NASDAQ:WYNN). We will take a look at Vedanta Ltd (NYSE:VEDL), Western Digital Corporation (NASDAQ:WDC), Icahn Enterprises LP (NASDAQ:IEP), and DexCom, Inc. (NASDAQ:DXCM). All of these stocks’ market caps are closest to WYNN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VEDL | 7 | 55731 | 2 |

| WDC | 25 | 566493 | -8 |

| IEP | 6 | 10137794 | 2 |

| DXCM | 31 | 738361 | 1 |

| Average | 17.25 | 2874595 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $2875 million. That figure was $1929 million in WYNN’s case. DexCom, Inc. (NASDAQ:DXCM) is the most popular stock in this table. On the other hand Icahn Enterprises LP (NASDAQ:IEP) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Wynn Resorts, Limited (NASDAQ:WYNN) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on WYNN, though not to the same extent, as the stock returned 17.7% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.