Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The fourth quarter of 2018 is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of World Wrestling Entertainment, Inc. (NYSE:WWE).

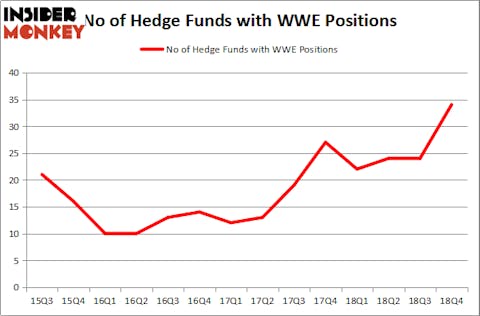

Is World Wrestling Entertainment, Inc. (NYSE:WWE) ready to rally soon? The smart money is turning bullish. The number of long hedge fund bets increased by 10 lately. Our calculations also showed that WWE isn’t among the 30 most popular stocks among hedge funds. WWE was in 34 hedge funds’ portfolios at the end of December. There were 24 hedge funds in our database with WWE holdings at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a peek at the fresh hedge fund action encompassing World Wrestling Entertainment, Inc. (NYSE:WWE).

What does the smart money think about World Wrestling Entertainment, Inc. (NYSE:WWE)?

Heading into the first quarter of 2019, a total of 34 of the hedge funds tracked by Insider Monkey were long this stock, a change of 42% from the previous quarter. The graph below displays the number of hedge funds with bullish position in WWE over the last 14 quarters. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Renaissance Technologies, managed by Jim Simons, holds the biggest position in World Wrestling Entertainment, Inc. (NYSE:WWE). Renaissance Technologies has a $193.7 million position in the stock, comprising 0.2% of its 13F portfolio. The second most bullish fund manager is Ken Griffin of Citadel Investment Group, with a $112 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism comprise Glen Kacher’s Light Street Capital, John Overdeck and David Siegel’s Two Sigma Advisors and Dmitry Balyasny’s Balyasny Asset Management.

As aggregate interest increased, key hedge funds were breaking ground themselves. Light Street Capital, managed by Glen Kacher, assembled the most outsized position in World Wrestling Entertainment, Inc. (NYSE:WWE). Light Street Capital had $48.2 million invested in the company at the end of the quarter. Robert Pohly’s Samlyn Capital also made a $32.1 million investment in the stock during the quarter. The following funds were also among the new WWE investors: James Parsons’s Junto Capital Management, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Steve Cohen’s Point72 Asset Management.

Let’s also examine hedge fund activity in other stocks similar to World Wrestling Entertainment, Inc. (NYSE:WWE). We will take a look at AerCap Holdings N.V. (NYSE:AER), Aspen Technology, Inc. (NASDAQ:AZPN), Columbia Sportswear Company (NASDAQ:COLM), and Douglas Emmett, Inc. (NYSE:DEI). This group of stocks’ market caps are similar to WWE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AER | 31 | 702579 | 9 |

| AZPN | 25 | 906269 | -3 |

| COLM | 24 | 232254 | 1 |

| DEI | 12 | 327862 | -2 |

| Average | 23 | 542241 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $542 million. That figure was $698 million in WWE’s case. AerCap Holdings N.V. (NYSE:AER) is the most popular stock in this table. On the other hand Douglas Emmett, Inc. (NYSE:DEI) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks World Wrestling Entertainment, Inc. (NYSE:WWE) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Hedge funds were also right about betting on WWE, though not to the same extent, as the stock returned 20.7% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.