While the market driven by short-term sentiment influenced by the accomodative interest rate environment in the US, increasing oil prices and deteriorating expectations towards the resolution of the trade war with China, many smart money investors kept their cautious approach regarding the current bull run in the second quarter and hedging or reducing many of their long positions. Some fund managers like this one are betting on Dow hitting 40,000 to generate strong returns. However, as we know, big investors usually buy stocks with strong fundamentals that can deliver gains both in bull and bear markets, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Vicor Corporation (NASDAQ:VICR).

Is Vicor Corporation (NASDAQ:VICR) worth your attention right now? Hedge funds are becoming more confident. The number of bullish hedge fund bets rose by 3 lately. Our calculations also showed that VICR isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are tons of formulas shareholders put to use to assess their holdings. Two of the most under-the-radar formulas are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the best picks of the top investment managers can outpace the S&P 500 by a solid margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s go over the recent hedge fund action surrounding Vicor Corporation (NASDAQ:VICR).

What does smart money think about Vicor Corporation (NASDAQ:VICR)?

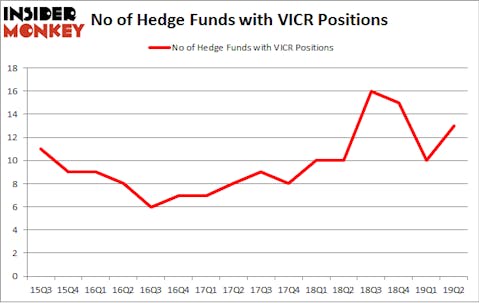

Heading into the third quarter of 2019, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 30% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards VICR over the last 16 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the number one position in Vicor Corporation (NASDAQ:VICR). AQR Capital Management has a $5 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Coming in second is Adam Usdan of Trellus Management Company, with a $4 million position; 5.5% of its 13F portfolio is allocated to the company. Some other peers that are bullish comprise Renaissance Technologies, Mark Broach’s Manatuck Hill Partners and Paul Tudor Jones’s Tudor Investment Corp.

As one would reasonably expect, key money managers were leading the bulls’ herd. Renaissance Technologies, established the largest position in Vicor Corporation (NASDAQ:VICR). Renaissance Technologies had $3.3 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also made a $0.9 million investment in the stock during the quarter. The other funds with brand new VICR positions are Chuck Royce’s Royce & Associates, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Joel Greenblatt’s Gotham Asset Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Vicor Corporation (NASDAQ:VICR) but similarly valued. We will take a look at Sandy Spring Bancorp Inc. (NASDAQ:SASR), Eidos Therapeutics, Inc. (NASDAQ:EIDX), Waddell & Reed Financial, Inc. (NYSE:WDR), and Easterly Government Properties Inc (NYSE:DEA). All of these stocks’ market caps are similar to VICR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SASR | 15 | 83501 | 1 |

| EIDX | 11 | 221663 | 3 |

| WDR | 18 | 127891 | 0 |

| DEA | 6 | 60382 | 0 |

| Average | 12.5 | 123359 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $123 million. That figure was $20 million in VICR’s case. Waddell & Reed Financial, Inc. (NYSE:WDR) is the most popular stock in this table. On the other hand Easterly Government Properties Inc (NYSE:DEA) is the least popular one with only 6 bullish hedge fund positions. Vicor Corporation (NASDAQ:VICR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately VICR wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on VICR were disappointed as the stock returned -4.9% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.