We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article we look at what those investors think of Vicor Corp (NASDAQ:VICR).

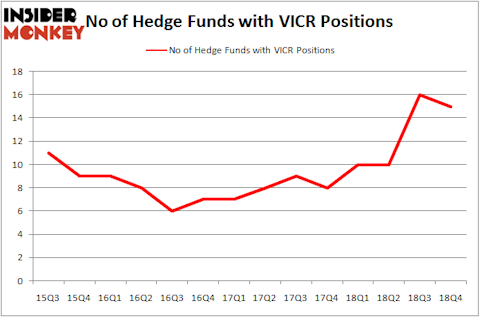

Is Vicor Corp (NASDAQ:VICR) a buy right now? The smart money is in a bearish mood. The number of long hedge fund bets fell by 1 lately. Our calculations also showed that VICR isn’t among the 30 most popular stocks among hedge funds. VICR was in 15 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 16 hedge funds in our database with VICR positions at the end of the previous quarter.

Today there are several metrics stock traders put to use to value stocks. Some of the most under-the-radar metrics are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the elite fund managers can outpace the market by a very impressive margin (see the details here).

Let’s take a glance at the latest hedge fund action surrounding Vicor Corp (NASDAQ:VICR).

How have hedgies been trading Vicor Corp (NASDAQ:VICR)?

At the end of the fourth quarter, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -6% from the second quarter of 2018. On the other hand, there were a total of 10 hedge funds with a bullish position in VICR a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

Among these funds, Bloom Tree Partners held the most valuable stake in Vicor Corp (NASDAQ:VICR), which was worth $30.2 million at the end of the fourth quarter. On the second spot was Trellus Management Company which amassed $4.8 million worth of shares. Moreover, Manatuck Hill Partners, AQR Capital Management, and Renaissance Technologies were also bullish on Vicor Corp (NASDAQ:VICR), allocating a large percentage of their portfolios to this stock.

Since Vicor Corp (NASDAQ:VICR) has witnessed bearish sentiment from hedge fund managers, logic holds that there were a few hedge funds who were dropping their entire stakes by the end of the third quarter. Intriguingly, Spencer M. Waxman’s Shannon River Fund Management dumped the biggest stake of all the hedgies followed by Insider Monkey, totaling an estimated $6.6 million in stock, and Richard Mashaal’s Rima Senvest Management was right behind this move, as the fund sold off about $4.8 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 1 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Vicor Corp (NASDAQ:VICR) but similarly valued. These stocks are Euronav NV (NYSE:EURN), Heartland Financial USA Inc (NASDAQ:HTLF), NBT Bancorp Inc. (NASDAQ:NBTB), and The Gabelli Dividend & Income Trust (NYSE:GDV). This group of stocks’ market values are closest to VICR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EURN | 11 | 130449 | -5 |

| HTLF | 7 | 13228 | 1 |

| NBTB | 9 | 7733 | 1 |

| GDV | 2 | 5135 | -1 |

| Average | 7.25 | 39136 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.25 hedge funds with bullish positions and the average amount invested in these stocks was $39 million. That figure was $49 million in VICR’s case. Euronav NV (NYSE:EURN) is the most popular stock in this table. On the other hand The Gabelli Dividend & Income Trust (NYSE:GDV) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Vicor Corp (NASDAQ:VICR) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately VICR wasn’t nearly as popular as these 15 stock and hedge funds that were betting on VICR were disappointed as the stock returned -17% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.