Legendary investors such as Jeffrey Talpins and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze Total System Services, Inc. (NYSE:TSS) from the perspective of those elite funds.

Hedge fund interest in Total System Services, Inc. (NYSE:TSS) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as American Airlines Group Inc (NASDAQ:AAL), Ctrip.com International, Ltd. (NASDAQ:CTRP), and ABIOMED, Inc. (NASDAQ:ABMD) to gather more data points.

In the eyes of most shareholders, hedge funds are seen as unimportant, old investment vehicles of yesteryear. While there are over 8000 funds with their doors open at the moment, We choose to focus on the elite of this club, around 750 funds. These hedge fund managers manage the majority of all hedge funds’ total asset base, and by tailing their top equity investments, Insider Monkey has determined numerous investment strategies that have historically outpaced Mr. Market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to go over the recent hedge fund action surrounding Total System Services, Inc. (NYSE:TSS).

What have hedge funds been doing with Total System Services, Inc. (NYSE:TSS)?

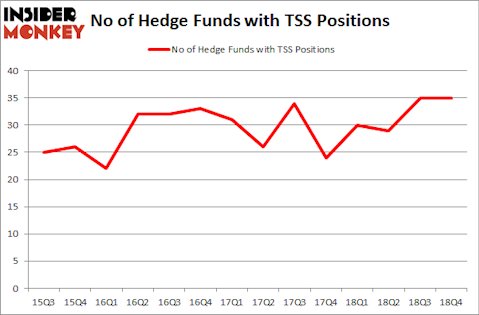

At Q4’s end, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the second quarter of 2018. On the other hand, there were a total of 30 hedge funds with a bullish position in TSS a year ago. With hedge funds’ capital changing hands, there exists a few notable hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

The largest stake in Total System Services, Inc. (NYSE:TSS) was held by Citadel Investment Group, which reported holding $360.6 million worth of stock at the end of September. It was followed by Balyasny Asset Management with a $140 million position. Other investors bullish on the company included Samlyn Capital, Millennium Management, and Junto Capital Management.

Since Total System Services, Inc. (NYSE:TSS) has experienced falling interest from the entirety of the hedge funds we track, logic holds that there exists a select few hedgies that slashed their full holdings in the third quarter. Intriguingly, Israel Englander’s Millennium Management sold off the biggest stake of the 700 funds watched by Insider Monkey, totaling an estimated $19.7 million in stock, and Vikas Lunia’s Lunia Capital was right behind this move, as the fund dumped about $15.7 million worth. These transactions are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Total System Services, Inc. (NYSE:TSS). We will take a look at American Airlines Group Inc (NASDAQ:AAL), Ctrip.com International, Ltd. (NASDAQ:CTRP), ABIOMED, Inc. (NASDAQ:ABMD), and Plains All American Pipeline, L.P. (NYSE:PAA). This group of stocks’ market values are closest to TSS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AAL | 45 | 2296666 | 6 |

| CTRP | 21 | 771724 | 2 |

| ABMD | 31 | 1301183 | 9 |

| PAA | 8 | 48965 | -2 |

| Average | 26.25 | 1104635 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.25 hedge funds with bullish positions and the average amount invested in these stocks was $1105 million. That figure was $1108 million in TSS’s case. American Airlines Group Inc (NASDAQ:AAL) is the most popular stock in this table. On the other hand Plains All American Pipeline, L.P. (NYSE:PAA) is the least popular one with only 8 bullish hedge fund positions. Total System Services, Inc. (NYSE:TSS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on TSS, though not to the same extent, as the stock returned 16.1% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.