Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved, lost nearly 40% of its value at one point in 2018. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 15 S&P 500 stocks among hedge funds at the end of December 2018 yielded an average return of 19.7% year-to-date, vs. a gain of 13.1% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of Rhythm Pharmaceuticals, Inc. (NASDAQ:RYTM).

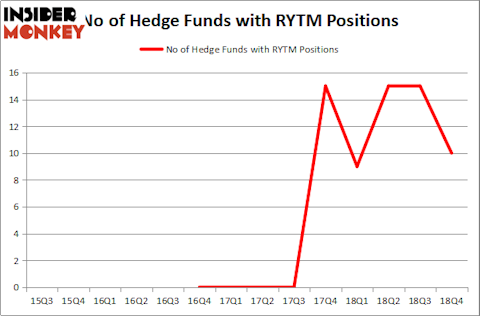

Rhythm Pharmaceuticals, Inc. (NASDAQ:RYTM) was in 10 hedge funds’ portfolios at the end of the fourth quarter of 2018. RYTM has seen a decrease in hedge fund interest in recent months. There were 15 hedge funds in our database with RYTM holdings at the end of the previous quarter. Our calculations also showed that RYTM isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most investors, hedge funds are perceived as unimportant, old financial tools of the past. While there are more than 8000 funds trading at present, Our researchers hone in on the upper echelon of this club, approximately 750 funds. These hedge fund managers orchestrate the lion’s share of the hedge fund industry’s total asset base, and by following their top stock picks, Insider Monkey has spotted a few investment strategies that have historically outpaced the market. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s analyze the fresh hedge fund action surrounding Rhythm Pharmaceuticals, Inc. (NASDAQ:RYTM).

What have hedge funds been doing with Rhythm Pharmaceuticals, Inc. (NASDAQ:RYTM)?

At Q4’s end, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of -33% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in RYTM over the last 14 quarters. With the smart money’s sentiment swirling, there exists a few noteworthy hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Julian Baker and Felix Baker’s Baker Bros. Advisors has the number one position in Rhythm Pharmaceuticals, Inc. (NASDAQ:RYTM), worth close to $72.8 million, accounting for 0.6% of its total 13F portfolio. The second most bullish fund manager is RA Capital Management, managed by Peter Kolchinsky, which holds a $52.4 million position; the fund has 3.1% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors with similar optimism consist of Samuel Isaly’s OrbiMed Advisors, Joseph Edelman’s Perceptive Advisors and Oleg Nodelman’s EcoR1 Capital.

Seeing as Rhythm Pharmaceuticals, Inc. (NASDAQ:RYTM) has witnessed bearish sentiment from the aggregate hedge fund industry, it’s safe to say that there was a specific group of hedgies who were dropping their positions entirely last quarter. At the top of the heap, Noam Gottesman’s GLG Partners sold off the biggest stake of the 700 funds monitored by Insider Monkey, valued at close to $1.6 million in stock. Phill Gross and Robert Atchinson’s fund, Adage Capital Management, also sold off its stock, about $0.7 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest fell by 5 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Rhythm Pharmaceuticals, Inc. (NASDAQ:RYTM). These stocks are InfraREIT Inc (NYSE:HIFR), PGT Innovations Inc. (NYSE:PGTI), Amphastar Pharmaceuticals Inc (NASDAQ:AMPH), and Garrett Motion Inc. (NYSE:GTX). This group of stocks’ market caps are closest to RYTM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HIFR | 15 | 197476 | 1 |

| PGTI | 20 | 112859 | -2 |

| AMPH | 8 | 11805 | 3 |

| GTX | 13 | 213936 | 8 |

| Average | 14 | 134019 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $134 million. That figure was $189 million in RYTM’s case. PGT Innovations Inc. (NYSE:PGTI) is the most popular stock in this table. On the other hand Amphastar Pharmaceuticals Inc (NASDAQ:AMPH) is the least popular one with only 8 bullish hedge fund positions. Rhythm Pharmaceuticals, Inc. (NASDAQ:RYTM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately RYTM wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); RYTM investors were disappointed as the stock returned -4.4% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.