Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The last 8 months is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 9 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Pioneer Natural Resources Company (NYSE:PXD).

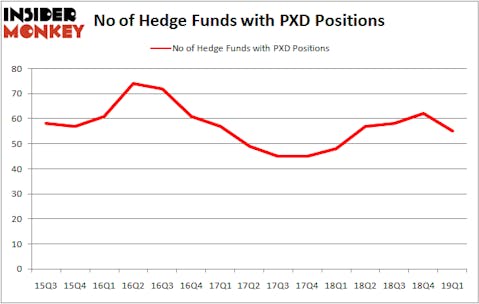

Is Pioneer Natural Resources Company (NYSE:PXD) a cheap investment now? Hedge funds are selling. The number of long hedge fund positions decreased by 7 in recent months. Our calculations also showed that PXD isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a look at the key hedge fund action regarding Pioneer Natural Resources Company (NYSE:PXD).

What does the smart money think about Pioneer Natural Resources Company (NYSE:PXD)?

At Q1’s end, a total of 55 of the hedge funds tracked by Insider Monkey were long this stock, a change of -11% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards PXD over the last 15 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Baupost Group was the largest shareholder of Pioneer Natural Resources Company (NYSE:PXD), with a stake worth $304.8 million reported as of the end of March. Trailing Baupost Group was Citadel Investment Group, which amassed a stake valued at $263.3 million. Adage Capital Management, Millennium Management, and Two Sigma Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as Pioneer Natural Resources Company (NYSE:PXD) has witnessed a decline in interest from the aggregate hedge fund industry, it’s easy to see that there was a specific group of money managers that elected to cut their positions entirely last quarter. It’s worth mentioning that Steve Cohen’s Point72 Asset Management cut the biggest stake of the 700 funds watched by Insider Monkey, worth close to $206.2 million in stock, and Todd J. Kantor’s Encompass Capital Advisors was right behind this move, as the fund said goodbye to about $55.9 million worth. These moves are important to note, as aggregate hedge fund interest fell by 7 funds last quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Pioneer Natural Resources Company (NYSE:PXD) but similarly valued. These stocks are Halliburton Company (NYSE:HAL), Agilent Technologies Inc. (NYSE:A), AutoZone, Inc. (NYSE:AZO), and Tyson Foods, Inc. (NYSE:TSN). All of these stocks’ market caps are closest to PXD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HAL | 38 | 854658 | 4 |

| A | 41 | 2099188 | 1 |

| AZO | 42 | 1209112 | 2 |

| TSN | 43 | 1534989 | 5 |

| Average | 41 | 1424487 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 41 hedge funds with bullish positions and the average amount invested in these stocks was $1424 million. That figure was $1687 million in PXD’s case. Tyson Foods, Inc. (NYSE:TSN) is the most popular stock in this table. On the other hand Halliburton Company (NYSE:HAL) is the least popular one with only 38 bullish hedge fund positions. Compared to these stocks Pioneer Natural Resources Company (NYSE:PXD) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately PXD wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on PXD were disappointed as the stock returned -5.2% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.