Is Opus Bank (NASDAQ:OPB) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably but historically their consensus stock picks outperformed the market after adjusting for known risk factors.

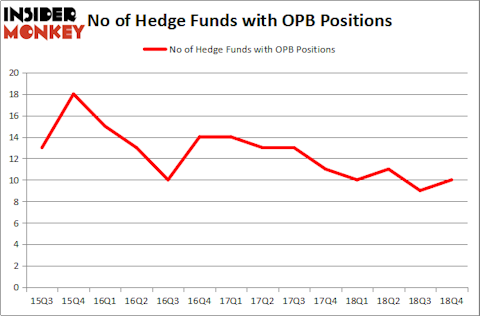

Opus Bank (NASDAQ:OPB) was in 10 hedge funds’ portfolios at the end of December. OPB has experienced an increase in hedge fund sentiment recently. There were 9 hedge funds in our database with OPB positions at the end of the previous quarter. Our calculations also showed that OPB isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most stock holders, hedge funds are perceived as slow, outdated investment tools of yesteryear. While there are over 8000 funds in operation at the moment, We look at the crème de la crème of this group, about 750 funds. Most estimates calculate that this group of people oversee the lion’s share of the smart money’s total capital, and by keeping an eye on their first-class picks, Insider Monkey has spotted numerous investment strategies that have historically outrun the market. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s take a look at the fresh hedge fund action encompassing Opus Bank (NASDAQ:OPB).

What have hedge funds been doing with Opus Bank (NASDAQ:OPB)?

At the end of the fourth quarter, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 11% from the previous quarter. By comparison, 10 hedge funds held shares or bullish call options in OPB a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

More specifically, Elliott Management was the largest shareholder of Opus Bank (NASDAQ:OPB), with a stake worth $106.2 million reported as of the end of December. Trailing Elliott Management was Mendon Capital Advisors, which amassed a stake valued at $14.1 million. Shoals Capital Management, Winton Capital Management, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, specific money managers have jumped into Opus Bank (NASDAQ:OPB) headfirst. Shoals Capital Management, managed by Jeffrey Hinkle, established the most outsized position in Opus Bank (NASDAQ:OPB). Shoals Capital Management had $11.8 million invested in the company at the end of the quarter. David Harding’s Winton Capital Management also made a $3 million investment in the stock during the quarter. The other funds with new positions in the stock are Israel Englander’s Millennium Management, Jim Simons’s Renaissance Technologies, and Benjamin A. Smith’s Laurion Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Opus Bank (NASDAQ:OPB) but similarly valued. We will take a look at Columbus McKinnon Corporation (NASDAQ:CMCO), Consolidated Communications Holdings Inc (NASDAQ:CNSL), Novavax, Inc. (NASDAQ:NVAX), and Lakeland Bancorp, Inc. (NASDAQ:LBAI). This group of stocks’ market values match OPB’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CMCO | 25 | 65825 | 5 |

| CNSL | 14 | 10831 | 4 |

| NVAX | 13 | 29470 | 1 |

| LBAI | 12 | 59102 | 0 |

| Average | 16 | 41307 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $41 million. That figure was $140 million in OPB’s case. Columbus McKinnon Corporation (NASDAQ:CMCO) is the most popular stock in this table. On the other hand Lakeland Bancorp, Inc. (NASDAQ:LBAI) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Opus Bank (NASDAQ:OPB) is even less popular than LBAI. Hedge funds dodged a bullet by taking a bearish stance towards OPB. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately OPB wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); OPB investors were disappointed as the stock returned 8.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.