We can judge whether OneMain Holdings Inc (NYSE:OMF) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

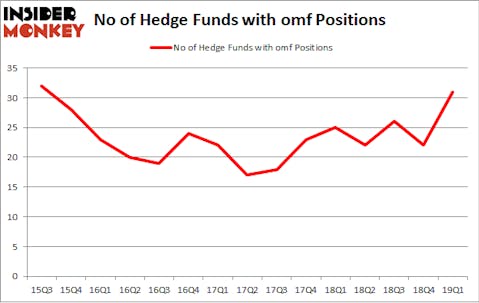

OneMain Holdings Inc (NYSE:OMF) was in 31 hedge funds’ portfolios at the end of March. OMF has experienced an increase in hedge fund interest recently. There were 22 hedge funds in our database with OMF holdings at the end of the previous quarter. Our calculations also showed that omf isn’t among the 30 most popular stocks among hedge funds.

At the moment there are dozens of gauges investors use to evaluate their stock investments. A duo of the most innovative gauges are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the best money managers can trounce the S&P 500 by a superb margin (see the details here).

We’re going to take a gander at the new hedge fund action regarding OneMain Holdings Inc (NYSE:OMF).

Hedge fund activity in OneMain Holdings Inc (NYSE:OMF)

At the end of the first quarter, a total of 31 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 41% from the previous quarter. The graph below displays the number of hedge funds with bullish position in OMF over the last 15 quarters. With hedge funds’ sentiment swirling, there exists a few key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

Among these funds, Basswood Capital held the most valuable stake in OneMain Holdings Inc (NYSE:OMF), which was worth $58.3 million at the end of the first quarter. On the second spot was Millennium Management which amassed $28.3 million worth of shares. Moreover, D E Shaw, Adage Capital Management, and Point72 Asset Management were also bullish on OneMain Holdings Inc (NYSE:OMF), allocating a large percentage of their portfolios to this stock.

Consequently, key money managers have been driving this bullishness. Maverick Capital, managed by Lee Ainslie, assembled the largest position in OneMain Holdings Inc (NYSE:OMF). Maverick Capital had $6.2 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also made a $4 million investment in the stock during the quarter. The other funds with new positions in the stock are Paul Marshall and Ian Wace’s Marshall Wace LLP, Minhua Zhang’s Weld Capital Management, and Noam Gottesman’s GLG Partners.

Let’s also examine hedge fund activity in other stocks similar to OneMain Holdings Inc (NYSE:OMF). These stocks are Lancaster Colony Corporation (NASDAQ:LANC), Kinross Gold Corporation (NYSE:KGC), Lumentum Holdings Inc (NASDAQ:LITE), and PS Business Parks Inc (NYSE:PSB). This group of stocks’ market caps match OMF’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LANC | 24 | 284865 | 12 |

| KGC | 19 | 318872 | 2 |

| LITE | 31 | 534593 | 0 |

| PSB | 12 | 53680 | 0 |

| Average | 21.5 | 298003 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $298 million. That figure was $238 million in OMF’s case. Lumentum Holdings Inc (NASDAQ:LITE) is the most popular stock in this table. On the other hand PS Business Parks Inc (NYSE:PSB) is the least popular one with only 12 bullish hedge fund positions. OneMain Holdings Inc (NYSE:OMF) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately OMF wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on OMF were disappointed as the stock returned -1.9% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.