During the fourth quarter the Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by nearly 7 percentage points as investors worried over the possible ramifications of rising interest rates. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Omnicell, Inc. (NASDAQ:OMCL) and see how the stock is affected by the recent hedge fund activity.

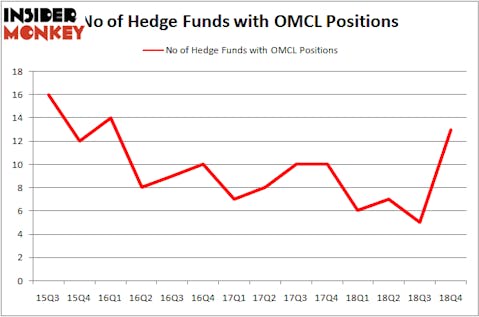

Is Omnicell, Inc. (NASDAQ:OMCL) the right pick for your portfolio? The smart money is taking a bullish view. The number of bullish hedge fund bets went up by 8 in recent months. Our calculations also showed that OMCL isn’t among the 30 most popular stocks among hedge funds. OMCL was in 13 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 5 hedge funds in our database with OMCL positions at the end of the previous quarter.

To most market participants, hedge funds are viewed as underperforming, old investment vehicles of the past. While there are greater than 8000 funds in operation at present, We look at the masters of this club, about 750 funds. These money managers handle the lion’s share of the hedge fund industry’s total capital, and by watching their matchless investments, Insider Monkey has unsheathed many investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to take a gander at the latest hedge fund action surrounding Omnicell, Inc. (NASDAQ:OMCL).

What have hedge funds been doing with Omnicell, Inc. (NASDAQ:OMCL)?

Heading into the first quarter of 2019, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 160% from the previous quarter. By comparison, 6 hedge funds held shares or bullish call options in OMCL a year ago. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Fisher Asset Management, managed by Ken Fisher, holds the most valuable position in Omnicell, Inc. (NASDAQ:OMCL). Fisher Asset Management has a $26.2 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second largest stake is held by Steve Cohen of Point72 Asset Management, with a $15.5 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions encompass Ken Griffin’s Citadel Investment Group, Richard Driehaus’s Driehaus Capital and Paul Marshall and Ian Wace’s Marshall Wace LLP.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. Point72 Asset Management, managed by Steve Cohen, initiated the most outsized position in Omnicell, Inc. (NASDAQ:OMCL). Point72 Asset Management had $15.5 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $11.4 million investment in the stock during the quarter. The following funds were also among the new OMCL investors: Richard Driehaus’s Driehaus Capital, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Israel Englander’s Millennium Management.

Let’s now review hedge fund activity in other stocks similar to Omnicell, Inc. (NASDAQ:OMCL). We will take a look at Box, Inc. (NYSE:BOX), Houlihan Lokey Inc (NYSE:HLI), Nextera Energy Partners LP (NYSE:NEP), and Rexnord Corp (NYSE:RXN). This group of stocks’ market values are similar to OMCL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BOX | 24 | 386086 | -2 |

| HLI | 18 | 138227 | 4 |

| NEP | 12 | 35346 | 0 |

| RXN | 19 | 133137 | 4 |

| Average | 18.25 | 173199 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $173 million. That figure was $64 million in OMCL’s case. Box, Inc. (NYSE:BOX) is the most popular stock in this table. On the other hand Nextera Energy Partners LP (NYSE:NEP) is the least popular one with only 12 bullish hedge fund positions. Omnicell, Inc. (NASDAQ:OMCL) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on OMCL, though not to the same extent, as the stock returned 17.7% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.