Before we spend countless hours researching a company, we’d like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Novartis AG (NYSE:NVS).

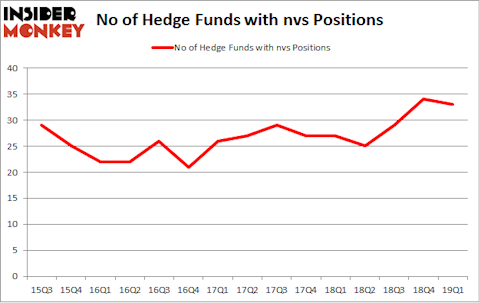

Is Novartis AG (NYSE:NVS) a buy here? Prominent investors are becoming less confident. The number of long hedge fund bets fell by 1 in recent months. Our calculations also showed that nvs isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are dozens of methods stock market investors have at their disposal to analyze their holdings. Some of the most useful methods are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the top picks of the top investment managers can beat the market by a superb amount (see the details here).

Let’s review the fresh hedge fund action regarding Novartis AG (NYSE:NVS).

How have hedgies been trading Novartis AG (NYSE:NVS)?

Heading into the second quarter of 2019, a total of 33 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -3% from one quarter earlier. On the other hand, there were a total of 27 hedge funds with a bullish position in NVS a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Fisher Asset Management held the most valuable stake in Novartis AG (NYSE:NVS), which was worth $653 million at the end of the first quarter. On the second spot was Arrowstreet Capital which amassed $450.1 million worth of shares. Moreover, Renaissance Technologies, Point72 Asset Management, and Millennium Management were also bullish on Novartis AG (NYSE:NVS), allocating a large percentage of their portfolios to this stock.

Due to the fact that Novartis AG (NYSE:NVS) has faced declining sentiment from the aggregate hedge fund industry, it’s easy to see that there is a sect of hedge funds who sold off their full holdings in the third quarter. Intriguingly, Dmitry Balyasny’s Balyasny Asset Management dropped the biggest position of all the hedgies watched by Insider Monkey, valued at close to $20.2 million in stock. Matthew Hulsizer’s fund, PEAK6 Capital Management, also dropped its stock, about $4.3 million worth. These bearish behaviors are important to note, as total hedge fund interest fell by 1 funds in the third quarter.

Let’s go over hedge fund activity in other stocks similar to Novartis AG (NYSE:NVS). These stocks are Wells Fargo & Company (NYSE:WFC), The Home Depot, Inc. (NYSE:HD), The Boeing Company (NYSE:BA), and Merck & Co., Inc. (NYSE:MRK). This group of stocks’ market caps match NVS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WFC | 73 | 25750715 | -4 |

| HD | 58 | 3544213 | 0 |

| BA | 71 | 4346311 | 4 |

| MRK | 64 | 4602295 | -4 |

| Average | 66.5 | 9560884 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 66.5 hedge funds with bullish positions and the average amount invested in these stocks was $9561 million. That figure was $1984 million in NVS’s case. Wells Fargo & Company (NYSE:WFC) is the most popular stock in this table. On the other hand The Home Depot, Inc. (NYSE:HD) is the least popular one with only 58 bullish hedge fund positions. Compared to these stocks Novartis AG (NYSE:NVS) is even less popular than HD. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on NVS, though not to the same extent, as the stock returned -0.4% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.