The elite funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Novartis AG (NYSE:NVS) from the perspective of those elite funds.

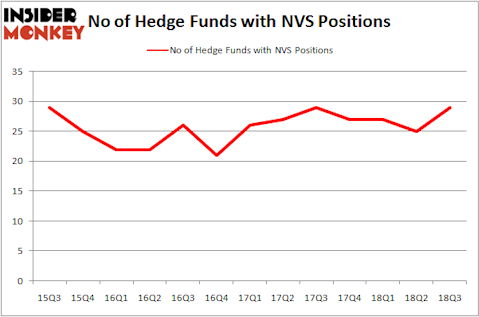

Novartis AG (NYSE:NVS) was in 29 hedge funds’ portfolios at the end of the third quarter of 2018. NVS investors should pay attention to an increase in support from the world’s most elite money managers recently. There were 25 hedge funds in our database with NVS positions at the end of the previous quarter. Our calculations also showed that NVS isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a peek at the latest hedge fund action surrounding Novartis AG (NYSE:NVS).

What does the smart money think about Novartis AG (NYSE:NVS)?

At Q3’s end, a total of 29 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 16% from the previous quarter. The graph below displays the number of hedge funds with bullish position in NVS over the last 13 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

The largest stake in Novartis AG (NYSE:NVS) was held by Fisher Asset Management, which reported holding $639.7 million worth of stock at the end of September. It was followed by Arrowstreet Capital with a $267.6 million position. Other investors bullish on the company included Renaissance Technologies, Millennium Management, and Point72 Asset Management.

With a general bullishness amongst the heavyweights, key hedge funds have been driving this bullishness. Point72 Asset Management, managed by Steve Cohen, assembled the largest position in Novartis AG (NYSE:NVS). Point72 Asset Management had $87.7 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also made a $67.7 million investment in the stock during the quarter. The other funds with new positions in the stock are Mike Vranos’s Ellington, Nick Thakore’s Diametric Capital, and Benjamin A. Smith’s Laurion Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Novartis AG (NYSE:NVS) but similarly valued. We will take a look at The Coca-Cola Company (NYSE:KO), Oracle Corporation (NASDAQ:ORCL), Merck & Co., Inc. (NYSE:MRK), and Toyota Motor Corporation (NYSE:TM). This group of stocks’ market caps match NVS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KO | 43 | 20664284 | 4 |

| ORCL | 49 | 8089171 | -1 |

| MRK | 63 | 5215578 | 4 |

| TM | 9 | 120997 | -4 |

| Average | 41 | 8522508 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 41 hedge funds with bullish positions and the average amount invested in these stocks was $8.52 billion. That figure was $1.73 billion in NVS’s case. Merck & Co., Inc. (NYSE:MRK) is the most popular stock in this table. On the other hand Toyota Motor Corporation (NYSE:TM) is the least popular one with only 9 bullish hedge fund positions. Novartis AG (NYSE:NVS) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MRK might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.