A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended March 31, so let’s proceed with the discussion of the hedge fund sentiment on Norwegian Cruise Line Holdings Ltd (NYSE:NCLH).

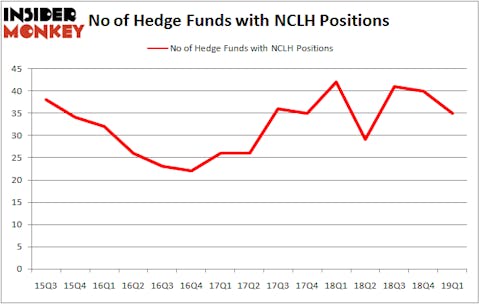

Norwegian Cruise Line Holdings Ltd (NYSE:NCLH) was in 35 hedge funds’ portfolios at the end of the first quarter of 2019. NCLH investors should be aware of a decrease in activity from the world’s largest hedge funds recently. There were 40 hedge funds in our database with NCLH positions at the end of the previous quarter. Our calculations also showed that NCLH isn’t among the 30 most popular stocks among hedge funds.

At the moment there are a lot of methods stock market investors use to grade publicly traded companies. A duo of the best methods are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the best picks of the elite investment managers can outclass the market by a healthy margin (see the details here).

We’re going to take a glance at the key hedge fund action regarding Norwegian Cruise Line Holdings Ltd (NYSE:NCLH).

Hedge fund activity in Norwegian Cruise Line Holdings Ltd (NYSE:NCLH)

Heading into the second quarter of 2019, a total of 35 of the hedge funds tracked by Insider Monkey were long this stock, a change of -13% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards NCLH over the last 15 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, HG Vora Capital Management, managed by Parag Vora, holds the largest position in Norwegian Cruise Line Holdings Ltd (NYSE:NCLH). HG Vora Capital Management has a $142.9 million position in the stock, comprising 10.5% of its 13F portfolio. Coming in second is Eminence Capital, managed by Ricky Sandler, which holds a $120.7 million position; 1.8% of its 13F portfolio is allocated to the stock. Remaining professional money managers that hold long positions encompass Cliff Asness’s AQR Capital Management, Ken Griffin’s Citadel Investment Group and John Overdeck and David Siegel’s Two Sigma Advisors.

Since Norwegian Cruise Line Holdings Ltd (NYSE:NCLH) has witnessed bearish sentiment from the entirety of the hedge funds we track, we can see that there was a specific group of hedgies that decided to sell off their full holdings in the third quarter. Interestingly, Ken Heebner’s Capital Growth Management said goodbye to the largest stake of all the hedgies monitored by Insider Monkey, totaling an estimated $49.4 million in stock. Richard Barrera’s fund, Roystone Capital Partners, also cut its stock, about $32.2 million worth. These transactions are important to note, as total hedge fund interest was cut by 5 funds in the third quarter.

Let’s go over hedge fund activity in other stocks similar to Norwegian Cruise Line Holdings Ltd (NYSE:NCLH). These stocks are Noble Energy, Inc. (NYSE:NBL), C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW), Nomura Holdings, Inc. (NYSE:NMR), and CarMax Inc (NYSE:KMX). All of these stocks’ market caps are closest to NCLH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NBL | 24 | 615273 | -2 |

| CHRW | 30 | 407519 | 3 |

| NMR | 5 | 36674 | 0 |

| KMX | 29 | 1641895 | 1 |

| Average | 22 | 675340 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $675 million. That figure was $1020 million in NCLH’s case. C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW) is the most popular stock in this table. On the other hand Nomura Holdings, Inc. (NYSE:NMR) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Norwegian Cruise Line Holdings Ltd (NYSE:NCLH) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on NCLH, though not to the same extent, as the stock returned 0.4% during the same period and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.