Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and small-cap stocks underperformed the market. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards MarineMax, Inc. (NYSE:HZO) to find out whether it was one of their high conviction long-term ideas.

Is MarineMax, Inc. (NYSE:HZO) an exceptional investment now? The best stock pickers are becoming more confident. The number of bullish hedge fund positions went up by 4 in recent months. Our calculations also showed that hzo isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Noam Gottesman, GLG Partners

We’re going to check out the new hedge fund action regarding MarineMax, Inc. (NYSE:HZO).

Hedge fund activity in MarineMax, Inc. (NYSE:HZO)

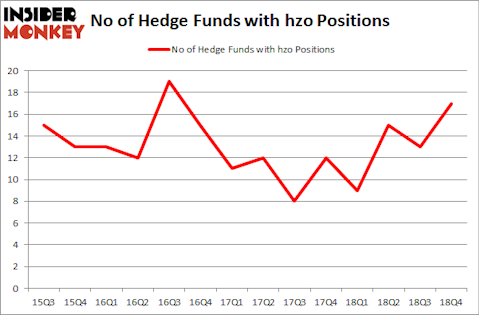

At the end of the fourth quarter, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 31% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in HZO over the last 14 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

Among these funds, Impala Asset Management held the most valuable stake in MarineMax, Inc. (NYSE:HZO), which was worth $11.7 million at the end of the fourth quarter. On the second spot was GLG Partners which amassed $10.8 million worth of shares. Moreover, Winton Capital Management, Maverick Capital, and Millennium Management were also bullish on MarineMax, Inc. (NYSE:HZO), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key money managers have been driving this bullishness. Winton Capital Management, managed by David Harding, established the most valuable position in MarineMax, Inc. (NYSE:HZO). Winton Capital Management had $6.5 million invested in the company at the end of the quarter. Lee Ainslie’s Maverick Capital also initiated a $5.9 million position during the quarter. The other funds with new positions in the stock are John Overdeck and David Siegel’s Two Sigma Advisors, D. E. Shaw’s D E Shaw, and Benjamin A. Smith’s Laurion Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as MarineMax, Inc. (NYSE:HZO) but similarly valued. We will take a look at Greenhill & Co., Inc. (NYSE:GHL), First Defiance Financial Corp. (NASDAQ:FDEF), Independent Bank Corporation (NASDAQ:IBCP), and RadNet Inc. (NASDAQ:RDNT). All of these stocks’ market caps match HZO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GHL | 13 | 51851 | 3 |

| FDEF | 7 | 28181 | -1 |

| IBCP | 11 | 50167 | 1 |

| RDNT | 14 | 72131 | 3 |

| Average | 11.25 | 50583 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.25 hedge funds with bullish positions and the average amount invested in these stocks was $51 million. That figure was $48 million in HZO’s case. RadNet Inc. (NASDAQ:RDNT) is the most popular stock in this table. On the other hand First Defiance Financial Corp. (NASDAQ:FDEF) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks MarineMax, Inc. (NYSE:HZO) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately HZO wasn’t nearly as popular as these 15 stock and hedge funds that were betting on HZO were disappointed as the stock returned 3.4% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.