Amid an overall market correction, many stocks that smart money investors were collectively bullish on tanked during the fourth quarter. Among them, Amazon and Netflix ranked among the top 30 picks and both lost more than 25%. Facebook, which was the second most popular stock, lost 20% amid uncertainty regarding the interest rates and tech valuations. Nevertheless, our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the first 2.5 months of 2019 and outperformed the broader market benchmark by 6.6 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

Karyopharm Therapeutics Inc (NASDAQ:KPTI) has seen a decrease in enthusiasm from smart money of late. Our calculations also showed that kpti isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most traders, hedge funds are seen as unimportant, outdated financial vehicles of yesteryear. While there are over 8000 funds trading today, Our researchers choose to focus on the moguls of this club, around 750 funds. These money managers oversee bulk of the smart money’s total asset base, and by following their top equity investments, Insider Monkey has deciphered various investment strategies that have historically surpassed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to take a peek at the recent hedge fund action surrounding Karyopharm Therapeutics Inc (NASDAQ:KPTI).

Hedge fund activity in Karyopharm Therapeutics Inc (NASDAQ:KPTI)

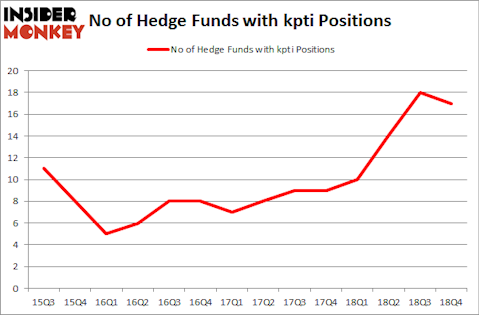

Heading into the first quarter of 2019, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -6% from the second quarter of 2018. On the other hand, there were a total of 10 hedge funds with a bullish position in KPTI a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

More specifically, Consonance Capital Management was the largest shareholder of Karyopharm Therapeutics Inc (NASDAQ:KPTI), with a stake worth $45.1 million reported as of the end of December. Trailing Consonance Capital Management was Palo Alto Investors, which amassed a stake valued at $43.9 million. Ridgeback Capital Management, Point72 Asset Management, and Deerfield Management were also very fond of the stock, giving the stock large weights in their portfolios.

Since Karyopharm Therapeutics Inc (NASDAQ:KPTI) has experienced a decline in interest from the aggregate hedge fund industry, it’s safe to say that there were a few funds that decided to sell off their full holdings last quarter. Interestingly, David Costen Haley’s HBK Investments dropped the biggest investment of the “upper crust” of funds watched by Insider Monkey, totaling close to $0.7 million in stock, and Philip Hempleman’s Ardsley Partners was right behind this move, as the fund said goodbye to about $0.2 million worth. These transactions are important to note, as total hedge fund interest was cut by 1 funds last quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Karyopharm Therapeutics Inc (NASDAQ:KPTI) but similarly valued. These stocks are Textainer Group Holdings Limited (NYSE:TGH), Virtus Investment Partners Inc (NASDAQ:VRTS), Akebia Therapeutics Inc (NASDAQ:AKBA), and Peoples Utah Bancorp (NASDAQ:PUB). This group of stocks’ market caps are similar to KPTI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TGH | 7 | 20962 | 0 |

| VRTS | 11 | 73397 | -2 |

| AKBA | 20 | 235207 | 1 |

| PUB | 3 | 15347 | 0 |

| Average | 10.25 | 86228 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.25 hedge funds with bullish positions and the average amount invested in these stocks was $86 million. That figure was $162 million in KPTI’s case. Akebia Therapeutics Inc (NASDAQ:AKBA) is the most popular stock in this table. On the other hand Peoples Utah Bancorp (NASDAQ:PUB) is the least popular one with only 3 bullish hedge fund positions. Karyopharm Therapeutics Inc (NASDAQ:KPTI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately KPTI wasn’t nearly as popular as these 15 stock and hedge funds that were betting on KPTI were disappointed as the stock returned -48.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.