At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

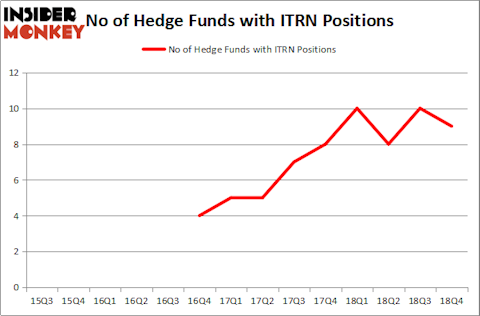

Is Ituran Location and Control Ltd. (US) (NASDAQ:ITRN) a worthy investment now? The smart money is selling. The number of bullish hedge fund positions decreased by 1 lately. Our calculations also showed that ITRN isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a glance at the recent hedge fund action encompassing Ituran Location and Control Ltd. (US) (NASDAQ:ITRN).

What have hedge funds been doing with Ituran Location and Control Ltd. (US) (NASDAQ:ITRN)?

Heading into the first quarter of 2019, a total of 9 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -10% from one quarter earlier. On the other hand, there were a total of 10 hedge funds with a bullish position in ITRN a year ago. With hedge funds’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in Ituran Location and Control Ltd. (US) (NASDAQ:ITRN), which was worth $43.7 million at the end of the fourth quarter. On the second spot was Gobi Capital which amassed $32.7 million worth of shares. Moreover, Simcoe Capital Management, Marshall Wace LLP, and Cove Street Capital were also bullish on Ituran Location and Control Ltd. (US) (NASDAQ:ITRN), allocating a large percentage of their portfolios to this stock.

Since Ituran Location and Control Ltd. (US) (NASDAQ:ITRN) has witnessed falling interest from the entirety of the hedge funds we track, it’s safe to say that there exists a select few hedge funds that slashed their full holdings last quarter. Interestingly, Israel Englander’s Millennium Management dropped the largest position of the 700 funds watched by Insider Monkey, comprising about $0.6 million in stock, and D. E. Shaw’s D E Shaw was right behind this move, as the fund dumped about $0.3 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest was cut by 1 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to Ituran Location and Control Ltd. (US) (NASDAQ:ITRN). These stocks are Dicerna Pharmaceuticals Inc (NASDAQ:DRNA), Oritani Financial Corp. (NASDAQ:ORIT), Northfield Bancorp Inc (NASDAQ:NFBK), and Franklin Street Properties Corp. (NYSEAMEX:FSP). This group of stocks’ market values resemble ITRN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DRNA | 20 | 247563 | 0 |

| ORIT | 8 | 39598 | 0 |

| NFBK | 4 | 29496 | 1 |

| FSP | 15 | 28612 | 8 |

| Average | 11.75 | 86317 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.75 hedge funds with bullish positions and the average amount invested in these stocks was $86 million. That figure was $106 million in ITRN’s case. Dicerna Pharmaceuticals Inc (NASDAQ:DRNA) is the most popular stock in this table. On the other hand Northfield Bancorp Inc (NASDAQ:NFBK) is the least popular one with only 4 bullish hedge fund positions. Ituran Location and Control Ltd. (US) (NASDAQ:ITRN) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately ITRN wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); ITRN investors were disappointed as the stock returned 14.8% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.