Reputable billionaire investors such as Jim Simons, Cliff Asness and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

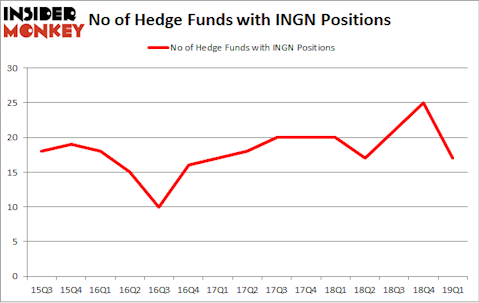

Inogen Inc (NASDAQ:INGN) has experienced a decrease in support from the world’s most elite money managers in recent months. Our calculations also showed that INGN isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most stock holders, hedge funds are assumed to be slow, outdated financial tools of years past. While there are greater than 8000 funds trading at present, We hone in on the bigwigs of this group, approximately 750 funds. These money managers manage bulk of the hedge fund industry’s total asset base, and by observing their first-class investments, Insider Monkey has formulated many investment strategies that have historically surpassed the market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

We’re going to take a gander at the recent hedge fund action regarding Inogen Inc (NASDAQ:INGN).

Hedge fund activity in Inogen Inc (NASDAQ:INGN)

At the end of the first quarter, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -32% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards INGN over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Inogen Inc (NASDAQ:INGN) was held by AQR Capital Management, which reported holding $26.7 million worth of stock at the end of March. It was followed by Citadel Investment Group with a $26.4 million position. Other investors bullish on the company included Renaissance Technologies, Two Sigma Advisors, and Millennium Management.

Due to the fact that Inogen Inc (NASDAQ:INGN) has experienced bearish sentiment from the smart money, logic holds that there were a few fund managers that decided to sell off their entire stakes in the third quarter. It’s worth mentioning that Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management said goodbye to the largest stake of the “upper crust” of funds followed by Insider Monkey, totaling about $14.5 million in stock. Dmitry Balyasny’s fund, Balyasny Asset Management, also cut its stock, about $9.6 million worth. These moves are important to note, as total hedge fund interest fell by 8 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Inogen Inc (NASDAQ:INGN). We will take a look at TransAlta Corporation (NYSE:TAC), Regenxbio Inc (NASDAQ:RGNX), CareTrust REIT, Inc. (NASDAQ:CTRE), and The Navigators Group, Inc (NASDAQ:NAVG). All of these stocks’ market caps match INGN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TAC | 11 | 29092 | 2 |

| RGNX | 19 | 317732 | 2 |

| CTRE | 16 | 108917 | 0 |

| NAVG | 16 | 222914 | -1 |

| Average | 15.5 | 169664 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $170 million. That figure was $136 million in INGN’s case. Regenxbio Inc (NASDAQ:RGNX) is the most popular stock in this table. On the other hand TransAlta Corporation (NYSE:TAC) is the least popular one with only 11 bullish hedge fund positions. Inogen Inc (NASDAQ:INGN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately INGN wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on INGN were disappointed as the stock returned -25.4% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.