After several tireless days we have finished crunching the numbers from nearly 750 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of March 31. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Innospec Inc. (NASDAQ:IOSP).

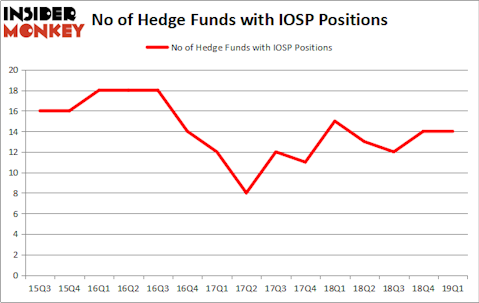

Innospec Inc. (NASDAQ:IOSP) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 14 hedge funds’ portfolios at the end of the first quarter of 2019. At the end of this article we will also compare IOSP to other stocks including The Medicines Company (NASDAQ:MDCO), ExlService Holdings, Inc. (NASDAQ:EXLS), and PQ Group Holdings Inc. (NYSE:PQG) to get a better sense of its popularity.

In the eyes of most market participants, hedge funds are perceived as underperforming, outdated investment tools of the past. While there are more than 8000 funds trading at the moment, Our experts choose to focus on the bigwigs of this group, around 750 funds. These hedge fund managers command most of the hedge fund industry’s total asset base, and by keeping an eye on their first-class stock picks, Insider Monkey has spotted a number of investment strategies that have historically surpassed the broader indices. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s go over the new hedge fund action encompassing Innospec Inc. (NASDAQ:IOSP).

What does smart money think about Innospec Inc. (NASDAQ:IOSP)?

Heading into the second quarter of 2019, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in IOSP over the last 15 quarters. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

More specifically, Royce & Associates was the largest shareholder of Innospec Inc. (NASDAQ:IOSP), with a stake worth $30.5 million reported as of the end of March. Trailing Royce & Associates was Huber Capital Management, which amassed a stake valued at $16.8 million. Millennium Management, Algert Coldiron Investors, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Innospec Inc. (NASDAQ:IOSP) has faced declining sentiment from the aggregate hedge fund industry, we can see that there was a specific group of hedgies that elected to cut their entire stakes in the third quarter. Intriguingly, Jim Simons’s Renaissance Technologies sold off the biggest position of the “upper crust” of funds tracked by Insider Monkey, comprising about $1.9 million in stock. Cliff Asness’s fund, AQR Capital Management, also said goodbye to its stock, about $0.6 million worth. These transactions are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to Innospec Inc. (NASDAQ:IOSP). We will take a look at The Medicines Company (NASDAQ:MDCO), ExlService Holdings, Inc. (NASDAQ:EXLS), PQ Group Holdings Inc. (NYSE:PQG), and Transportadora de Gas del Sur SA (NYSE:TGS). This group of stocks’ market valuations resemble IOSP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MDCO | 25 | 582391 | 5 |

| EXLS | 10 | 42850 | -1 |

| PQG | 6 | 56295 | 2 |

| TGS | 12 | 33129 | 4 |

| Average | 13.25 | 178666 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $179 million. That figure was $61 million in IOSP’s case. The Medicines Company (NASDAQ:MDCO) is the most popular stock in this table. On the other hand PQ Group Holdings Inc. (NYSE:PQG) is the least popular one with only 6 bullish hedge fund positions. Innospec Inc. (NASDAQ:IOSP) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on IOSP, though not to the same extent, as the stock returned 4.1% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.