You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

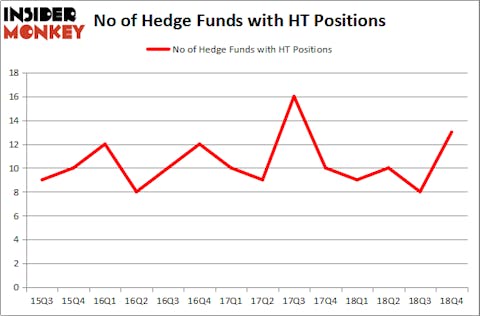

Hersha Hospitality Trust (NYSE:HT) was in 13 hedge funds’ portfolios at the end of December. HT has seen an increase in hedge fund sentiment lately. There were 8 hedge funds in our database with HT holdings at the end of the previous quarter. Our calculations also showed that HT isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s review the recent hedge fund action encompassing Hersha Hospitality Trust (NYSE:HT).

How have hedgies been trading Hersha Hospitality Trust (NYSE:HT)?

Heading into the first quarter of 2019, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of 63% from the second quarter of 2018. By comparison, 9 hedge funds held shares or bullish call options in HT a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, 1060 Capital Management was the largest shareholder of Hersha Hospitality Trust (NYSE:HT), with a stake worth $12.6 million reported as of the end of December. Trailing 1060 Capital Management was Renaissance Technologies, which amassed a stake valued at $8.4 million. SG Capital Management, Millennium Management, and GLG Partners were also very fond of the stock, giving the stock large weights in their portfolios.

Now, specific money managers have jumped into Hersha Hospitality Trust (NYSE:HT) headfirst. 1060 Capital Management, managed by Brian Gustavson and Andrew Haley, assembled the most valuable position in Hersha Hospitality Trust (NYSE:HT). 1060 Capital Management had $12.6 million invested in the company at the end of the quarter. Ken Grossman and Glen Schneider’s SG Capital Management also initiated a $4.8 million position during the quarter. The following funds were also among the new HT investors: Cliff Asness’s AQR Capital Management, Dmitry Balyasny’s Balyasny Asset Management, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Hersha Hospitality Trust (NYSE:HT) but similarly valued. These stocks are Sohu.com Limited (NASDAQ:SOHU), Cerus Corporation (NASDAQ:CERS), Astec Industries, Inc. (NASDAQ:ASTE), and EMC Insurance Group Inc. (NASDAQ:EMCI). All of these stocks’ market caps are similar to HT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SOHU | 10 | 93208 | -1 |

| CERS | 15 | 90900 | -3 |

| ASTE | 10 | 75982 | 0 |

| EMCI | 5 | 21306 | 3 |

| Average | 10 | 70349 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $70 million. That figure was $37 million in HT’s case. Cerus Corporation (NASDAQ:CERS) is the most popular stock in this table. On the other hand EMC Insurance Group Inc. (NASDAQ:EMCI) is the least popular one with only 5 bullish hedge fund positions. Hersha Hospitality Trust (NYSE:HT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately HT wasn’t nearly as popular as these 15 stock and hedge funds that were betting on HT were disappointed as the stock returned 3% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.