“Value has performed relatively poorly since the 2017 shift, but we believe challenges to the S&P 500’s dominance are mounting and resulting active opportunities away from the index are growing. At some point, this fault line will break, likely on the back of rising rates, and all investors will be reminded that the best time to diversify away from the winners is when it is most painful. The bargain of capturing long-term value may be short-term pain, but enough is eventually enough and it comes time to harvest the benefits.,” said Clearbridge Investments in its market commentary. We aren’t sure whether long-term interest rates will top 5% and value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. That’s why we believe it would be worthwhile to take a look at the hedge fund sentiment on Healthcare Realty Trust Inc (NYSE:HR) in order to identify whether reputable and successful top money managers continue to believe in its potential.

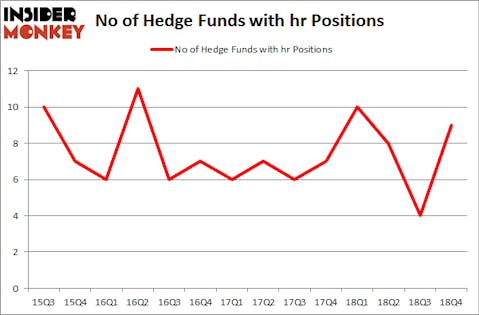

Healthcare Realty Trust Inc (NYSE:HR) was in 9 hedge funds’ portfolios at the end of December. HR investors should be aware of an increase in enthusiasm from smart money in recent months. There were 4 hedge funds in our database with HR holdings at the end of the previous quarter. Our calculations also showed that hr isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s take a gander at the fresh hedge fund action surrounding Healthcare Realty Trust Inc (NYSE:HR).

What have hedge funds been doing with Healthcare Realty Trust Inc (NYSE:HR)?

At Q4’s end, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, a change of 125% from the second quarter of 2018. By comparison, 10 hedge funds held shares or bullish call options in HR a year ago. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Paul Singer’s Elliott Management has the largest position in Healthcare Realty Trust Inc (NYSE:HR), worth close to $18 million, amounting to 0.1% of its total 13F portfolio. The second most bullish fund manager is Carlson Capital, managed by Clint Carlson, which holds a $15.1 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions consist of Sander Gerber’s Hudson Bay Capital Management, Ken Griffin’s Citadel Investment Group and Cliff Asness’s AQR Capital Management.

Now, key money managers were leading the bulls’ herd. Elliott Management, managed by Paul Singer, established the largest position in Healthcare Realty Trust Inc (NYSE:HR). Elliott Management had $18 million invested in the company at the end of the quarter. Sander Gerber’s Hudson Bay Capital Management also initiated a $6.8 million position during the quarter. The following funds were also among the new HR investors: Ray Dalio’s Bridgewater Associates, Matthew Hulsizer’s PEAK6 Capital Management, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s go over hedge fund activity in other stocks similar to Healthcare Realty Trust Inc (NYSE:HR). These stocks are Ritchie Bros. Auctioneers Incorporated (NYSE:RBA), Echostar Corporation (NASDAQ:SATS), ViaSat, Inc. (NASDAQ:VSAT), and Ingevity Corporation (NYSE:NGVT). This group of stocks’ market valuations match HR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RBA | 12 | 90035 | -3 |

| SATS | 34 | 422161 | 6 |

| VSAT | 19 | 1763482 | 1 |

| NGVT | 17 | 123490 | -2 |

| Average | 20.5 | 599792 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.5 hedge funds with bullish positions and the average amount invested in these stocks was $600 million. That figure was $44 million in HR’s case. Echostar Corporation (NASDAQ:SATS) is the most popular stock in this table. On the other hand Ritchie Bros. Auctioneers Incorporated (NYSE:RBA) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Healthcare Realty Trust Inc (NYSE:HR) is even less popular than RBA. Hedge funds dodged a bullet by taking a bearish stance towards HR. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately HR wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); HR investors were disappointed as the stock returned 6.3% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.