As we already know from media reports and hedge fund investor letters, many hedge funds lost money in fourth quarter, blaming macroeconomic conditions and unpredictable events that hit several sectors, with technology among them. Nevertheless, most investors decided to stick to their bullish theses and recouped their losses by the end of the first quarter. We get to see hedge funds’ thoughts towards the market and individual stocks by aggregating their quarterly portfolio movements and reading their investor letters. In this article, we will particularly take a look at what hedge funds think about Golar LNG Limited (NASDAQ:GLNG).

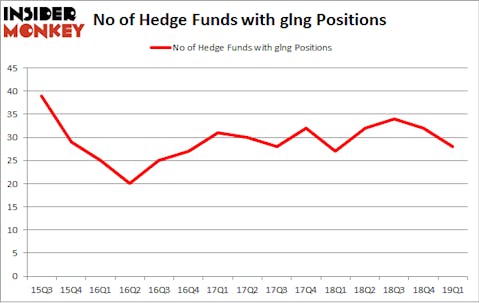

Golar LNG Limited (NASDAQ:GLNG) investors should pay attention to a decrease in activity from the world’s largest hedge funds recently. GLNG was in 28 hedge funds’ portfolios at the end of March. There were 32 hedge funds in our database with GLNG holdings at the end of the previous quarter. Our calculations also showed that glng isn’t among the 30 most popular stocks among hedge funds.

Today there are a lot of formulas shareholders use to size up publicly traded companies. A couple of the best formulas are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a significant margin (see the details here).

Let’s take a peek at the recent hedge fund action encompassing Golar LNG Limited (NASDAQ:GLNG).

Hedge fund activity in Golar LNG Limited (NASDAQ:GLNG)

At Q1’s end, a total of 28 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -13% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards GLNG over the last 15 quarters. With hedge funds’ sentiment swirling, there exists a few key hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, William B. Gray’s Orbis Investment Management has the most valuable position in Golar LNG Limited (NASDAQ:GLNG), worth close to $195.9 million, comprising 1.3% of its total 13F portfolio. On Orbis Investment Management’s heels is Luxor Capital Group, led by Christian Leone, holding a $33 million position; 1.1% of its 13F portfolio is allocated to the company. Other professional money managers that are bullish encompass Jim Simons’s Renaissance Technologies, and Israel Englander’s Millennium Management.

Since Golar LNG Limited (NASDAQ:GLNG) has witnessed a decline in interest from the aggregate hedge fund industry, it’s easy to see that there is a sect of funds who were dropping their full holdings in the third quarter. It’s worth mentioning that Daniel Arbess’s Perella Weinberg Partners sold off the largest position of the 700 funds watched by Insider Monkey, worth an estimated $19.7 million in stock, and Ed Bosek’s BeaconLight Capital was right behind this move, as the fund cut about $16.5 million worth. These moves are important to note, as total hedge fund interest was cut by 4 funds in the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Golar LNG Limited (NASDAQ:GLNG) but similarly valued. These stocks are CNX Resources Corporation (NYSE:CNX), Lexington Realty Trust (NYSE:LXP), Belden Inc. (NYSE:BDC), and BioTelemetry, Inc. (NASDAQ:BEAT). All of these stocks’ market caps match GLNG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CNX | 21 | 706206 | -2 |

| LXP | 18 | 89917 | 2 |

| BDC | 16 | 68629 | 1 |

| BEAT | 21 | 36868 | -3 |

| Average | 19 | 225405 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $225 million. That figure was $423 million in GLNG’s case. CNX Resources Corporation (NYSE:CNX) is the most popular stock in this table. On the other hand Belden Inc. (NYSE:BDC) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Golar LNG Limited (NASDAQ:GLNG) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately GLNG wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on GLNG were disappointed as the stock returned -12.5% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.