“October lived up to its scary reputation—the S&P 500 falling in the month by the largest amount in the last 40 years, the only worse Octobers being ’08 and the Crash of ’87. For perspective, there have been only 5 occasions in those 40 years when the S&P 500 declined by greater than 20% from peak to trough. Other than the ’87 Crash, all were during recessions. There were 17 other instances, over the same time frame, when the market fell by over 10% but less than 20%. Furthermore, this is the 18th correction of 5% or more since the current bull market started in March ’09. Corrections are the norm. They can be healthy as they often undo market complacency—overbought levels—potentially allowing the market to base and move even higher.” This is how Trapeze Asset Management summarized the recent market moves in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

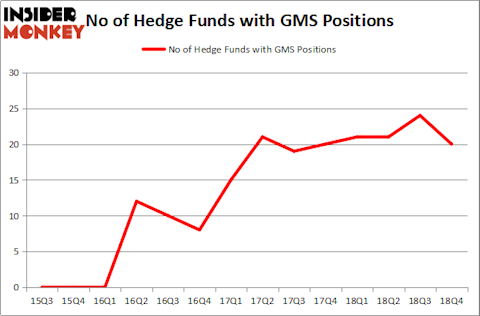

Is GMS Inc. (NYSE:GMS) a healthy stock for your portfolio? Hedge funds are getting less optimistic. The number of long hedge fund positions were trimmed by 4 lately. Our calculations also showed that GMS isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most shareholders, hedge funds are seen as slow, outdated financial vehicles of years past. While there are over 8000 funds with their doors open at present, Our researchers hone in on the masters of this group, approximately 750 funds. These investment experts manage bulk of the hedge fund industry’s total capital, and by keeping track of their matchless equity investments, Insider Monkey has revealed numerous investment strategies that have historically outperformed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s go over the key hedge fund action regarding GMS Inc. (NYSE:GMS).

How have hedgies been trading GMS Inc. (NYSE:GMS)?

At the end of the fourth quarter, a total of 20 of the hedge funds tracked by Insider Monkey were long this stock, a change of -17% from the previous quarter. On the other hand, there were a total of 21 hedge funds with a bullish position in GMS a year ago. With hedgies’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

More specifically, Adage Capital Management was the largest shareholder of GMS Inc. (NYSE:GMS), with a stake worth $31.3 million reported as of the end of December. Trailing Adage Capital Management was Park West Asset Management, which amassed a stake valued at $13.7 million. Rubric Capital Management, Millennium Management, and AQR Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Since GMS Inc. (NYSE:GMS) has witnessed falling interest from the entirety of the hedge funds we track, logic holds that there exists a select few hedgies that slashed their positions entirely in the third quarter. It’s worth mentioning that Noam Gottesman’s GLG Partners dumped the biggest stake of the 700 funds monitored by Insider Monkey, comprising close to $7.5 million in stock, and Jerome L. Simon’s Lonestar Capital Management was right behind this move, as the fund dumped about $5.7 million worth. These transactions are intriguing to say the least, as total hedge fund interest dropped by 4 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks similar to GMS Inc. (NYSE:GMS). We will take a look at Opera Limited (NASDAQ:OPRA), Bojangles’ Inc (NASDAQ:BOJA), ProQR Therapeutics NV (NASDAQ:PRQR), and Waitr Holdings Inc. (NASDAQ:WTRH). This group of stocks’ market caps are similar to GMS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OPRA | 5 | 5242 | -3 |

| BOJA | 12 | 37500 | -2 |

| PRQR | 11 | 104917 | -1 |

| WTRH | 18 | 166535 | -2 |

| Average | 11.5 | 78549 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.5 hedge funds with bullish positions and the average amount invested in these stocks was $79 million. That figure was $97 million in GMS’s case. Waitr Holdings Inc. (NASDAQ:WTRH) is the most popular stock in this table. On the other hand Opera Limited (NASDAQ:OPRA) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks GMS Inc. (NYSE:GMS) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately GMS wasn’t nearly as popular as these 15 stock and hedge funds that were betting on GMS were disappointed as the stock returned 16.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.