Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze GMS Inc. (NYSE:GMS) from the perspective of those elite funds.

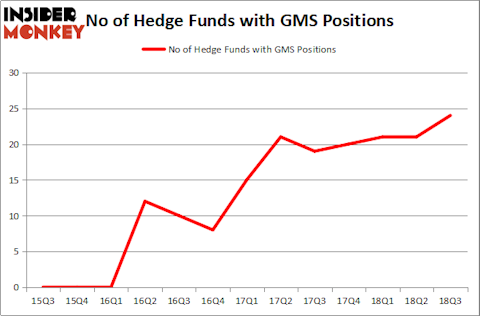

GMS Inc. (NYSE:GMS) was in 24 hedge funds’ portfolios at the end of the third quarter of 2018. GMS shareholders have witnessed an increase in hedge fund interest recently. There were 21 hedge funds in our database with GMS holdings at the end of the previous quarter. Our calculations also showed that GMS isn’t among the 30 most popular stocks among hedge funds.

At the moment there are several signals stock traders put to use to assess publicly traded companies. Two of the most under-the-radar signals are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the elite money managers can outclass the S&P 500 by a healthy margin (see the details here).

Let’s review the recent hedge fund action encompassing GMS Inc. (NYSE:GMS).

Hedge fund activity in GMS Inc. (NYSE:GMS)

At Q3’s end, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 14% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards GMS over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Rubric Capital Management was the largest shareholder of GMS Inc. (NYSE:GMS), with a stake worth $46.6 million reported as of the end of September. Trailing Rubric Capital Management was Park West Asset Management, which amassed a stake valued at $33.9 million. Adage Capital Management, AQR Capital Management, and Gratia Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Now, specific money managers have jumped into GMS Inc. (NYSE:GMS) headfirst. Adage Capital Management, managed by Phill Gross and Robert Atchinson, initiated the biggest position in GMS Inc. (NYSE:GMS). Adage Capital Management had $23.2 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $13.4 million position during the quarter. The other funds with brand new GMS positions are Jerome L. Simon’s Lonestar Capital Management, Jim Simons’s Renaissance Technologies, and Brad Dunkley and Blair Levinsky’s Waratah Capital Advisors.

Let’s now review hedge fund activity in other stocks similar to GMS Inc. (NYSE:GMS). These stocks are National Research Corporation (NASDAQ:NRC), The Gorman-Rupp Company (NYSEAMEX:GRC), Central European Media Enterprises Ltd. (NASDAQ:CETV), and General American Investors Company, Inc. (NYSE:GAM). This group of stocks’ market values are similar to GMS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NRC | 6 | 37818 | 2 |

| GRC | 9 | 41554 | 0 |

| CETV | 7 | 2168 | -1 |

| GAM | 5 | 26754 | 1 |

| Average | 6.75 | 27074 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $27 million. That figure was $229 million in GMS’s case. The Gorman-Rupp Company (NYSEAMEX:GRC) is the most popular stock in this table. On the other hand General American Investors Company, Inc. (NYSE:GAM) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks GMS Inc. (NYSE:GMS) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.