Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space.

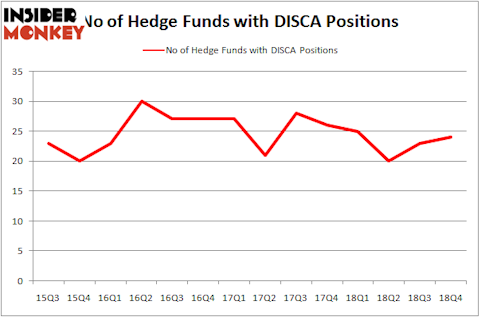

Is Discovery, Inc. (NASDAQ:DISCA) a buy, sell, or hold? The smart money is getting more bullish. The number of bullish hedge fund positions increased by 1 in recent months. Our calculations also showed that DISCA isn’t among the 30 most popular stocks among hedge funds. DISCA was in 24 hedge funds’ portfolios at the end of December. There were 23 hedge funds in our database with DISCA holdings at the end of the previous quarter.

In the financial world there are dozens of methods investors use to size up stocks. Some of the best methods are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the best picks of the elite investment managers can outpace the S&P 500 by a superb margin (see the details here).

We’re going to take a glance at the new hedge fund action surrounding Discovery, Inc. (NASDAQ:DISCA).

What have hedge funds been doing with Discovery, Inc. (NASDAQ:DISCA)?

At the end of the fourth quarter, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 4% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards DISCA over the last 14 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

Among these funds, Citadel Investment Group held the most valuable stake in Discovery, Inc. (NASDAQ:DISCA), which was worth $73.7 million at the end of the third quarter. On the second spot was D E Shaw which amassed $42.6 million worth of shares. Moreover, Millennium Management, GAMCO Investors, and CQS Cayman LP were also bullish on Discovery, Inc. (NASDAQ:DISCA), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key hedge funds were breaking ground themselves. CQS Cayman LP, managed by Michael Hintze, assembled the most valuable position in Discovery, Inc. (NASDAQ:DISCA). CQS Cayman LP had $27.3 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also made a $4.1 million investment in the stock during the quarter. The other funds with brand new DISCA positions are David Costen Haley’s HBK Investments, John Overdeck and David Siegel’s Two Sigma Advisors, and Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Discovery, Inc. (NASDAQ:DISCA) but similarly valued. These stocks are D.R. Horton, Inc. (NYSE:DHI), Lennar Corporation (NYSE:LEN), Annaly Capital Management, Inc. (NYSE:NLY), and MGM Resorts International (NYSE:MGM). All of these stocks’ market caps match DISCA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DHI | 47 | 1783354 | -2 |

| LEN | 62 | 1693184 | -4 |

| NLY | 16 | 160541 | -7 |

| MGM | 46 | 1590466 | -3 |

| Average | 42.75 | 1306886 | -4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 42.75 hedge funds with bullish positions and the average amount invested in these stocks was $1307 million. That figure was $318 million in DISCA’s case. Lennar Corporation (NYSE:LEN) is the most popular stock in this table. On the other hand Annaly Capital Management, Inc. (NYSE:NLY) is the least popular one with only 16 bullish hedge fund positions. Discovery, Inc. (NASDAQ:DISCA) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately DISCA wasn’t in this group. Hedge funds that bet on DISCA were disappointed as the stock returned 10.9% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.