The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their June 28 holdings, data that is available nowhere else. Should you consider Commercial Metals Company (NYSE:CMC) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

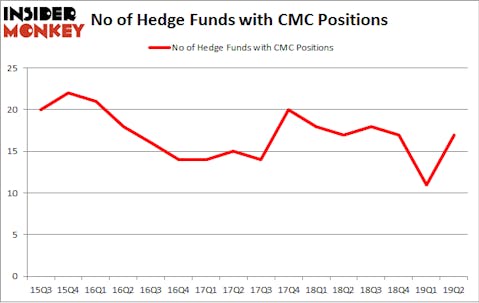

Commercial Metals Company (NYSE:CMC) investors should pay attention to an increase in enthusiasm from smart money of late. CMC was in 17 hedge funds’ portfolios at the end of June. There were 11 hedge funds in our database with CMC positions at the end of the previous quarter. Our calculations also showed that CMC isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to check out the key hedge fund action regarding Commercial Metals Company (NYSE:CMC).

How are hedge funds trading Commercial Metals Company (NYSE:CMC)?

At Q2’s end, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 55% from one quarter earlier. By comparison, 17 hedge funds held shares or bullish call options in CMC a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

Among these funds, Citadel Investment Group held the most valuable stake in Commercial Metals Company (NYSE:CMC), which was worth $87.5 million at the end of the second quarter. On the second spot was Highline Capital Management which amassed $79.1 million worth of shares. Moreover, Luminus Management, Balyasny Asset Management, and Royce & Associates were also bullish on Commercial Metals Company (NYSE:CMC), allocating a large percentage of their portfolios to this stock.

Consequently, key hedge funds have been driving this bullishness. Balyasny Asset Management, managed by Dmitry Balyasny, created the most outsized position in Commercial Metals Company (NYSE:CMC). Balyasny Asset Management had $13.5 million invested in the company at the end of the quarter. Alexander Mitchell’s Scopus Asset Management also initiated a $11.2 million position during the quarter. The other funds with new positions in the stock are Robert Polak’s Anchor Bolt Capital, Paul Tudor Jones’s Tudor Investment Corp, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s go over hedge fund activity in other stocks similar to Commercial Metals Company (NYSE:CMC). These stocks are Cannae Holdings, Inc. (NYSE:CNNE), TTEC Holdings, Inc. (NASDAQ:TTEC), Patterson Companies, Inc. (NASDAQ:PDCO), and Mack-Cali Realty Corporation (NYSE:CLI). This group of stocks’ market valuations match CMC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CNNE | 19 | 275079 | -5 |

| TTEC | 17 | 43423 | 2 |

| PDCO | 23 | 195300 | -5 |

| CLI | 13 | 153567 | 2 |

| Average | 18 | 166842 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $167 million. That figure was $290 million in CMC’s case. Patterson Companies, Inc. (NASDAQ:PDCO) is the most popular stock in this table. On the other hand Mack-Cali Realty Corporation (NYSE:CLI) is the least popular one with only 13 bullish hedge fund positions. Commercial Metals Company (NYSE:CMC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately CMC wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); CMC investors were disappointed as the stock returned -2% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.