Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example in the first 2.5 months of this year the Standard and Poor’s 500 Index returned approximately 13.1% (including dividend payments). Conversely, hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the same 2.5-month period, with 93% of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only 5% due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns (5%) versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like Alliance Data Systems Corporation (NYSE:ADS).

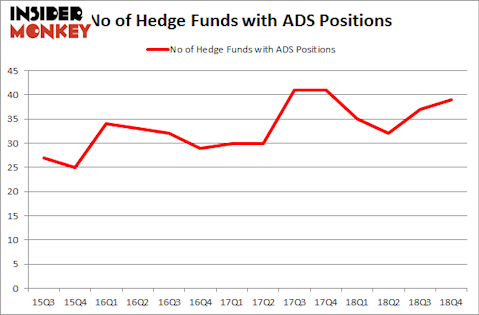

Alliance Data Systems Corporation (NYSE:ADS) investors should pay attention to an increase in enthusiasm from smart money in recent months. ADS was in 39 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 37 hedge funds in our database with ADS holdings at the end of the previous quarter. Our calculations also showed that ADS isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to go over the fresh hedge fund action regarding Alliance Data Systems Corporation (NYSE:ADS).

What does the smart money think about Alliance Data Systems Corporation (NYSE:ADS)?

Heading into the first quarter of 2019, a total of 39 of the hedge funds tracked by Insider Monkey were long this stock, a change of 5% from the previous quarter. On the other hand, there were a total of 35 hedge funds with a bullish position in ADS a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

More specifically, ValueAct Capital was the largest shareholder of Alliance Data Systems Corporation (NYSE:ADS), with a stake worth $781.6 million reported as of the end of September. Trailing ValueAct Capital was Brave Warrior Capital, which amassed a stake valued at $261.5 million. Arlington Value Capital, Bridgewater Associates, and Gobi Capital were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, key hedge funds have jumped into Alliance Data Systems Corporation (NYSE:ADS) headfirst. Gobi Capital, managed by Bo Shan, created the largest position in Alliance Data Systems Corporation (NYSE:ADS). Gobi Capital had $55.8 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also initiated a $29.8 million position during the quarter. The following funds were also among the new ADS investors: Steve Cohen’s Point72 Asset Management, Marcelo Desio’s Lucha Capital Management, and Michael Gelband’s ExodusPoint Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Alliance Data Systems Corporation (NYSE:ADS) but similarly valued. These stocks are Huntington Ingalls Industries Inc (NYSE:HII), Arconic Inc. (NYSE:ARNC), Wayfair Inc (NYSE:W), and LINE Corporation (NYSE:LN). All of these stocks’ market caps match ADS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HII | 27 | 580335 | 1 |

| ARNC | 46 | 2480470 | 6 |

| W | 28 | 1439728 | -2 |

| LN | 4 | 52978 | -1 |

| Average | 26.25 | 1138378 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.25 hedge funds with bullish positions and the average amount invested in these stocks was $1138 million. That figure was $1728 million in ADS’s case. Arconic Inc. (NYSE:ARNC) is the most popular stock in this table. On the other hand LINE Corporation (NYSE:LN) is the least popular one with only 4 bullish hedge fund positions. Alliance Data Systems Corporation (NYSE:ADS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Hedge funds were also right about betting on ADS, though not to the same extent, as the stock returned 19.3% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.